Interchange fees have been deemed anti-competitive: What’s next for merchants to achieve a reclaim?

After several years of economic and legal battle over the rate of Multilateral Interchange Fees (MIFs), set by Visa and Mastercard, the UK’s Supreme Court has handed down a landmark ruling in a resounding victory for the merchant community. The decision means merchants now have the chance to reclaim historical interchange fees - with the potential for a significant cash boost at a time when many retailers are experiencing substantial revenue loss, as a result of the COVID-19 pandemic.

Interchange fees have been a strain on retailers across the globe for decades, with the British Retail Consortium lodging an initial complaint to the European Commission back in 1992. Set by the schemes but paid to issuing banks, interchange fees are fixed, non-negotiable and are usually a merchant’s third largest cost item, after labour and rent. The European Commission introduced the Interchange Fee Regulation (IFR) in 2015 to help address the problem posed by excessive interchange: however, despite delivering a number of benefits to the merchant community, the IFR did not resolve the issue entirely.

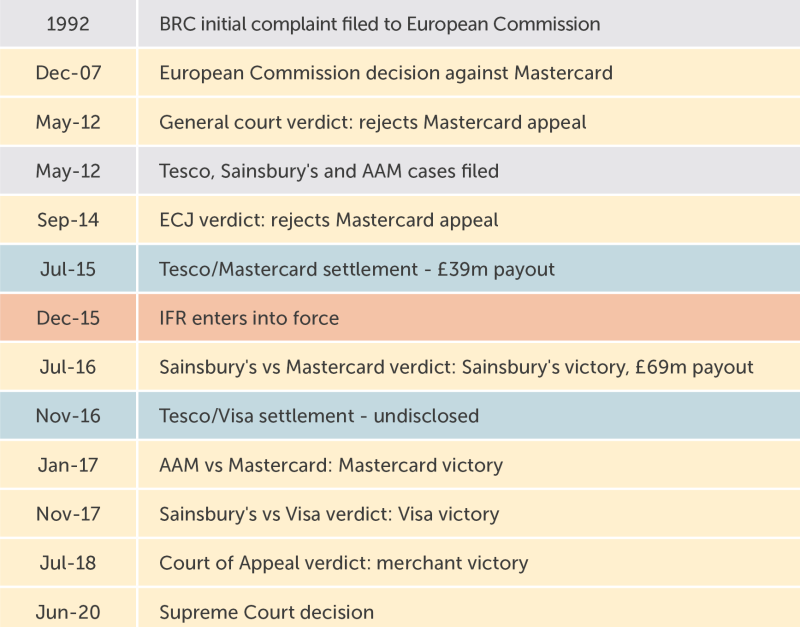

Many merchants believe interchange fees are fundamentally anti-competitive, resulting in multiple legal proceedings being brought against Visa and Mastercard to recoup the damages incurred. The Supreme Court case is the eighth in a series of European and UK court judgments relating to interchange fees, ultimately ruling MIFs are anti-competitive. Prior to this recent victory, the legal process has thus far been lengthy and challenging for merchants, with very few receiving substantial payouts either through direct negotiation or litigation.

A breakdown of the relevant case history can be found in the following chart:

Despite the historic challenges for merchants, the June 2020 judgment has provided the strongest opportunity yet for the merchant community to receive significant compensation – with the key legal arguments finding in the merchants’ favour. However, several obstacles still remain, which merchants must overcome in order to receive the maximum reclaim.

Based on claims from 2013, the maximum payout for UK merchants could be an estimated €17bn, and as much as €68bn for european merchants.

The 4 Key Issues Addressed by the Judgment

The Supreme Court case involved AAM (Asda, Argos and Morrisons) and Sainsbury’s as the claimants, with Visa and Mastercard as the two defendants, and focused on Article 101 of the Treaty of the Functioning of the European Union (TFEU) – which addresses restriction of competition.

The judgment addressed four key issues: (i) whether MIFs restricted competition under Article 101(1); (ii) what burden of proof lies with the defendant(s) in establishing an exemption to Article 101(1); (iii) who was the relevant “consumer” in assessing the “fair share” requirement under Article 101(3); and (iv) whether the “broad axe” approach applied when alleging pass-on of the costs of anti-competitive MIFs.

The Supreme Court found resoundingly in the merchants’ favour on the Article 101(1) issue, deeming MIFs anti-competitive and a restriction of competition by effect. The Justices ruled that in the absence of the illegal MIFs, no interchange would have been charged because there would be no bilaterally negotiated interchange fees (BIFs), as neither issuers nor merchants would have an incentive to pay an interchange fee.

On the issue of the burden of proof for the schemes in establishing an exemption under Article 101(3) – which explores whether an anti-competitive practice can nonetheless be permitted at some level if it is proven to produce economic benefits – it was decided that the schemes must demonstrate with clear and empirical evidence, as opposed to economic theory alone, that a claiming merchant, as the relevant consumer, has received as much benefit from the MIFs as it has paid out. Quantifying the benefits merchants receive will be enormously challenging for the schemes: however, it is set to be case-specific and therefore merchants should anticipate arguments from schemes on this issue.

Merchants must now accurately calculate and fully substantiate their claims to stand up against the schemes’ scrutiny and achieve the maximum pay-out.

The judgment was an overall success for merchants: however, the ‘broad-axe’ issue remains an obstacle as the lone successful argument made by the schemes in the Sainsbury’s case. The Court’s decision held that, once the schemes have raised the issue of mitigation of the MIFs through pass-on – which can arise through merchants negotiating lower prices with suppliers or passing on the MIFs to consumers through higher prices – a heavy burden is placed on the merchant to provide evidence that demonstrates whether, and to what extent, MIFs were actually passed on. As a result of this decision, merchants now have to undertake robust analysis to fully quantify their claims and assess their internal decision making in relation to MIFs to receive maximum compensation.

What’s Next for Merchants?

Lodging and pursuing an interchange reclaim is by no means a straightforward process. Merchants are potentially limited in resource, analytical insights and visibility of an incredibly opaque payments market, in order to counter both the schemes' pass-on arguments and quantify the true extent of their losses. Merchants need economic expertise to stand up to scheme scrutiny and receive the payouts they’re entitled to - any broad-brush calculations, gaps in analysis, assumptions or unsubstantiated claims will likely result in significantly reduced reclaims.

Nevertheless, the Supreme Court's ruling has the potential for the UK retail industry to receive billions, with some individual merchants poised to claim tens of millions back from the schemes.

At CMSPI, we have been supporting the UK merchant community with interchange reclaims for many years – using our payments industry expertise, unique benchmarking insights and in-depth transactional analysis to accurately calculate and fully substantiate our clients’ claims. As independent merchant champions, we’re proud to be supporting the community to maximise their claims and stand up against the schemes’ scrutiny.

Contact details

The time is ticking for merchants to lodge a claim due to a limitation on liability periods. If you would like to find out more about interchange litigation and how we can help maximise the value of your claim, please get in touch via email: cgodwin@cmspi.com

To find out more about CMSPI and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.