Retailers who act early this festive season will be best placed to capture new and shifting shopper demands

After a uniquely challenging festive period in 2020, retailers can look forward to better times in 2021. The U.K. population is estimated to have amassed excess savings equivalent to £215 billion over the past year, giving good reason to plan and hope for a Christmas spending boom.

But cause for optimism isn’t cause for complacency. The pandemic has both accelerated and created vast changes in the way we shop. Consumers have shifted to digital, and they have higher expectations that don’t stop at the product or service: they are also looking to engage in conscious consumption that reflects their values.

The latest data from Google indicates that many of these changes are here for the long term. So how will these shifting behaviours continue to affect retail at the busiest time of the year? We’ve identified five key trends from Google research, consumer surveys, and search data for the peak season — and actions retailers should take to meet consumers’ changing demands.

1 Christmas shopping has been extended

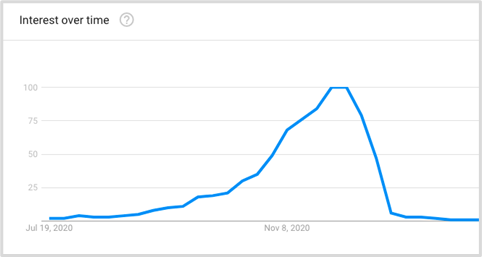

Retailers have always planned for the festive period far in advance, but shoppers are fast catching up with them. In Google’s latest survey of Christmas shoppers, more Britons said they liked to get most of their Christmas shopping done early in the season than previously1 — a sentiment we see reflected in Google Trends, with interest in “Christmas gifts” now starting to climb as early as August.

This translates into an extended peak period covering Black Friday, Christmas, and the sales — with the savviest retailers monitoring changing trends online and ensuring they’re ready to capture early bird demand as it arises.

Actions: Keep pace with what the nation is searching for. With Google Trends, retailers can monitor search interest on relevant terms and categories — gleaning real-time insights to identify changes in demand and potential new profit opportunities earlier in the year.

2 New online behaviours are driving retail growth

73% of growth in retail-related searches on Google in the U.K. last year was from new or rarely searched for terms2 — a figure that demonstrates the scale of new digital shopping behaviours. It’s also indicative of the changing role of search in an increasingly complex purchase journey, as more people go online not just to click ‘‘buy’’ but to seek inspiration.

Measuring online to offline sales is also increasingly important. Recent research by Analytic Partners has shown at least 50% of revenues generated by search and social media are captured in-store.

Actions: Establish a single KPI across all your channels. The most advanced retailers take a holistic view of marketing effectiveness — both online and offline — to navigate purchase journey complexity and overcome the issue of siloed teams working to different goals.

3 Competition between brands is increasing

Discovery behaviour moving online and a wider shift to digital is also creating a more competitive environment, where retailers of all sizes can seek a bigger slice of the market and build customer loyalties. In the past year, depending on the category, 25% to 30% of consumers said they tried a new brand.3 And the vast majority of consumers report they’ll stay loyal in the future: 75% of womenswear and 82% of menswear shoppers who bought from a new brand during the pandemic say they’ll continue shopping with them in the coming six months.4

Actions: Ensure your ads are being seen by the right audience at the right time by using automated tools such as Smart Bidding to optimise your campaign — monitoring click share to ensure you’re not missing out to the competition. Finance teams can empower marketing with a budget that can flex in line with market demand and avoid any sort of artificial cap on growth.

4 Retail apps are going from strength to strength

If you want to recruit valuable customers this Christmas, now is the time to invest in apps and the marketing strategy behind them. App users generate 3.5 times more revenue than other shoppers and have a higher repeat purchase rate, according to a recent eMarketer study. If mobile isn’t already a priority, it’s never been more important to make that shift — mobile commerce in retail is forecast to pass £100 billion by 2024.

Actions: Build app marketing campaigns that identify, recruit, and retain high-value customers. Spend can be aligned with your key trading periods, creating visibility on seasonal offers and promotions and helping you capture peak demand.

Search interest in “Christmas gifts” now starts to climb as early as August.

5 Retailers who show purpose will shine

We can expect to see ethical gifting grow in prominence over the coming months. Consumers are increasingly not only looking for a specific product but also for a retailer with ethics and purpose that align with their own — and the personal nature of gift-giving makes that particularly relevant. In a Google survey, 55% of shoppers5 said sustainability was more important to them than value and quality. Expect to see this attitude informing wishlists and present shopping.

Actions: Communicate your brand purpose and values authentically and consistently. It’s important to avoid “greenwashing” (that is, making ethical statements that aren’t backed up by actions), as this tends to push customers away in the long term. Instead, focus on publicising the values that are true to the way you do business.

1 Google/Ipsos, U.K., Holiday Shopping Study, n=3,150 (online Britons 18+ who shopped for Christmas in the past two days), Nov. 2020–Jan. 2021.

2 Google Internal Data, U.K., 2020.

3 Google/Trinity McQueen, U.K., n=1,000 consumers per category, Jan. 2021.

4 Google/Trinity McQueen, U.K., n=1,000 consumers per category, Jan. 2021.

5 Google/Basis research, U.K. adults, 2020 (n=4,000)

To find out more about Google and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.