Many UK retailers overlook the importance of the timely processing of refunds.

If we change our mind about a purchase, or if something is faulty, we simply need to return the product with our proof of purchase and the retailer will provide a replacement or refund. Offering generous returns policies of anywhere between 14 days and a whole year, as well as free return shipping for online sales, are just two of the ways that UK retailers are using to differentiate themselves from the competition and attract and retain customers.

This is great unless we pay by credit or debit card, which are the most common payment methods in the UK today. Refunds will go back onto the same card used to make the purchase so customers wait 3-5 working days for the refund to show up in their account. One major UK retailer even warns its online shoppers of refunds taking up to a full month.

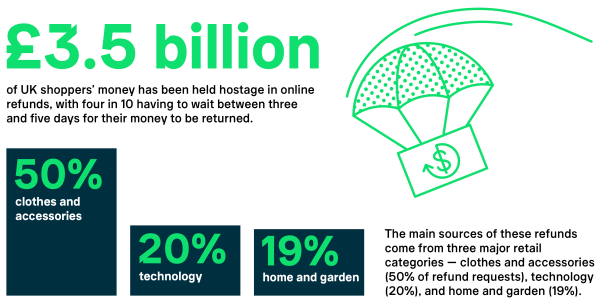

In the past year alone, more than £3.5 billion of UK shoppers’ money has been held hostage in online refunds. The main sources of these refunds come from three major retail categories — clothes and accessories (50% of refund requests), technology (20%), and home and garden (19%).

At Trustly, we are digging deeper into this issue, because not only is this a lost revenue opportunity, as I will explain below, but it is costing retailers more to handle slower refunds. The process can involve collecting manual information and the long lead-time can cause many consumers to contact customer services to chase up their refund.

Card payments are built on slow rails and often rely on slow processes and involve a chain of different players with different SLAs, who move the money between customers and retailers and back again in the event of a refund.

A recent survey carried out on behalf of Trustly of over 10,000 consumers and 1,000 retailers from 10 major European markets reveals that the timely processing of refunds is a core factor affecting customer experience. The refund process influences how shoppers feel about a brand more than many retailers may realise. It affects not only their initial decision to shop with that brand but also long-term loyalty.

The survey confirmed that when customers make a return, they want their money refunded faster. Shorter refund times have a direct impact on sales, since customers often wait until after they receive their refund to make a new purchase. This is especially important in the battle to win the loyalty of younger consumers. Those we surveyed were much more likely to hold off spending until a refund has cleared. This is possibly because they have less disposable income or purchasing power, so they need to wait for the money to be refunded.

In a follow-up survey, more than a quarter of respondents (28%) said they had been directly impacted regarding their capacity to pay bills, rent and mortgage contributions as a result of having money tied up in online refunds. Almost half (45%) told us that slow refunds are hampering their ability to make financial plans, which means they are more likely to resort to taking out loans and paying interest on debts.

Immediate gratification associated with ‘instant culture’ that sets expectations for all customer experiences regardless of industry, means customers are becoming less tolerant of delayed refunds and have no issues in chasing the refunds.

Despite the opportunity to uplift customer acquisition, spend value and loyalty, most retailers do not yet offer same-day refunds because legacy payment systems don’t allow it and, until now, no better solution has been available.

Automated, instant refunds like Trustly Online Banking Payments let customers choose a fast, convenient payment option as well as seamless refunds. If convenience, speed and simplicity are cornerstones of customer experience, then Online Banking Payments can set the bar for both in-store and online purchases. By offering quicker, more convenient and flexible refunds, online retailers can embrace this consumer dynamic and help gain more control over their spending. Yet, in order for this to happen, reliance on legacy systems and laborious internal processes must come to an end.

Our data provides the business case for this transition. Of the more than 2,500 shoppers surveyed, 63% said that they were more likely to spend money with the same e-commerce retailer if they received a refund quickly. Put simply, faster refund processes will ensure shoppers are back online sooner and with greater frequency. By supporting consumers’ cash flow through efficient and fast refunds, online retailers can also boost their own bottom line and enhance brand loyalty.

Realising the potential of instant refunds with Trustly means retailers can include automated refunds as a valuable step in the customer journey. Trustly’s vast bank coverage of more than 6,300 banks across the world means that refunds can easily be processed in a wide range of different currencies. Easy activation and multi-currency functionality gives retailers the power to expand their businesses across borders with access to ovr 525 million customers in Europe, the Americas and Australia.

To find out more about Trustly and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.