Underestimating the power of payments innovation will put vital revenues and profits at risk in today’s competitive e-commerce environment

Paying for things used to be simple and, for a long time, unchanging. But in the last few years we’ve seen a rapid shift in payment habits, with consumers using card, mobile and electronic wallets to make their purchases. And, as the consumer has become more discerning, merchants have had their pick of innovative ways to encourage them to part with their money.

But over time, introducing new payment service providers or payment methods has brought new complexity and pain for retailers trying to manage the payment stack and eliminate ongoing operational risks – it’s the primary reason why the majority of European e-commerce businesses still don’t support ‘local’ payment methods and offer limited choice to customers. Change can seem daunting but the digital payment landscape is fertile with innovation and, as we shall see, this presents a rich opportunity for those capable of unleashing its potential. Retailers may find themselves restricted and constrained if they don’t adopt a strategic approach and create an agile payments environment in order to innovate and evolve at pace.

Understanding the difficulties

Traditional arrangements and point-to-point connections (between retail and payment processors) no longer work for today’s dynamic world of online commerce, consumer diversity and varied preferences. Traditional point-to-point arrangements are no longer sufficient because they offer little resilience and lack the ability to route between providers to optimise transaction rates. This silo-based approach also creates further additional technical and operational complexity.

Many retailers are paying heed. A recent survey from ACI Worldwide found that merchants are increasingly turning to multiple acquirers. The survey also found that 85% of merchants increased conversions after moving to multiple acquirer relationships.

We all know that shoppers frequently abandon transactions if their preferred digital payment type isn’t available. Consumer expectation is high and retailers must respond to this. In an e-commerce world, customers can be anywhere, and if they can’t pay you they can’t buy from you, so catering for different markets is key.

Time for a different approach

With e-commerce growth being accelerated by the pandemic, it is crucial to get the payment process right, now more than ever. For many businesses, keeping pace with the changing innovation in payments can be difficult. For larger organisations implementing change can be a challenge, frightening even.

But it is essential

Consumers are more aware than ever of their choices. Failure to offer a sufficiently wide range of payment methods means shutting the door in the face of potential sales. Customers may prefer certain methods over others for any number of reasons, ranging from fee structures to privacy concerns to how secure they believe the system is. It is essential to respond to preferred payment methods across different audiences and territories, in order to create a smooth customer experience, increase conversion and drive loyalty.

But whilst allowing customers to pay in their preferred or local payment type is important, it can lead to complexity in the payments stack, with potential payment silos that offer little resilience and limited flexibility. Intelligently routing payments across available services will mitigate against any individual payment outages and failed transactions, ensuring business continuity, optimising payment success and safeguarding customer experiences.

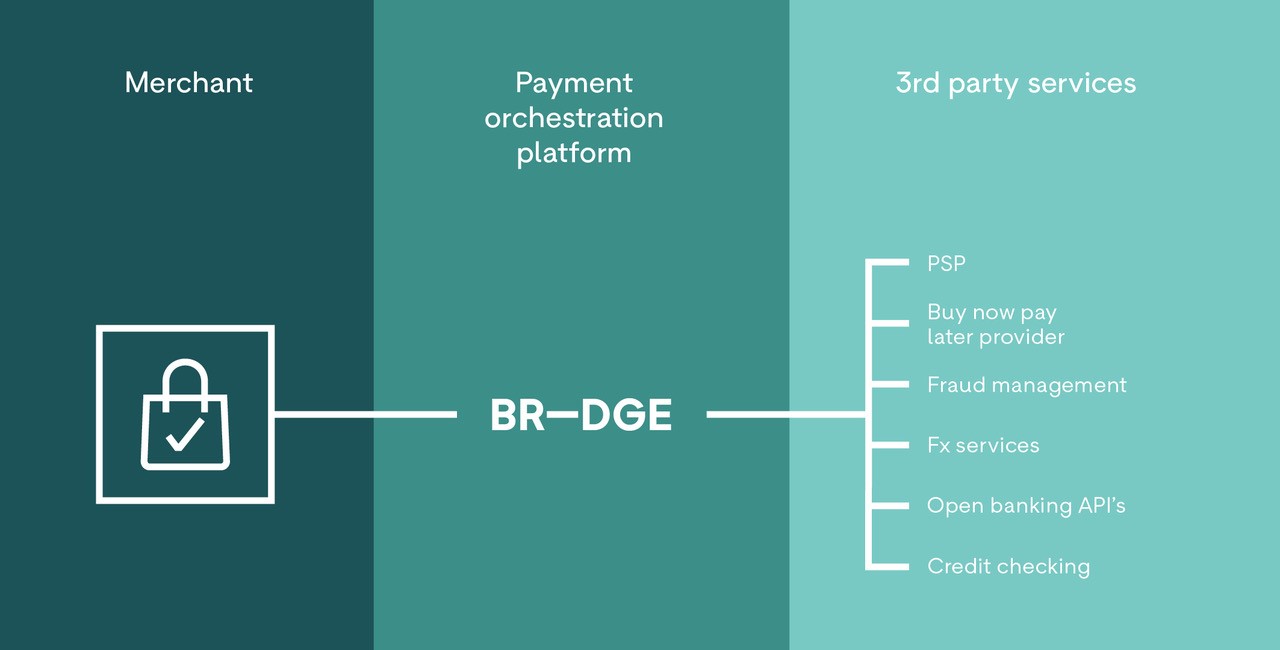

Payment orchestration enables transactions to be carried out by multiple payment providers with simple and flexible plugins. It allows users to add (or remove) providers easily, knowing the complexity (detecting outages and automatically rerouting payments) is being handled by a trusted specialist partner.

This type of technology helps to create a more competitive opportunity for retailers, minimising the cost and risk of switching or introducing new payment providers and affording a safe environment for innovation, such as trialing a new payment type. Payment orchestration also provides transparency in the payment system, routing transactions in the most optimum way, as well as delivering merchants new data insights into customers’ payment behaviour and preferences.

Having everything in place for greater payments agility is essential for success, and payments orchestration may be the vehicle to achieve this.

Future-proofing payments

Allowing a resilient and agile payment flow also allows retailers to work freely in different markets, by incorporating known and trusted local payment methods. This gives businesses the freedom they need to grow in an innovative and agile way, reaching new customers and better supporting their current ones.

Merchants need to be ready for increasing amounts of change. Innovations in open banking, digital IDs and the continued rise of alternate payment methods, as well as increased security measures, will put new demands on retailers. For example, open banking payments have the potential to offer significant benefits such as the reduction of processing fees. The challenge will be how these new payment methods are adopted and incorporated with existing methods in a seamless way. Having everything in place for greater payments agility is essential for success, and payments orchestration may be the vehicle to achieve this.

None of us can predict what the next few years will look like, but if there’s one thing we do know, it’s that those retailers who embrace payment innovations and strive to retain accountability and control will be the ones who survive and thrive in our digitally-driven retail future.

With e-commerce growth being accelerated by the pandemic, it is crucial to get the payment process right, now more than ever.

To find out more about Bridge and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.