Three learnings from a challenging year

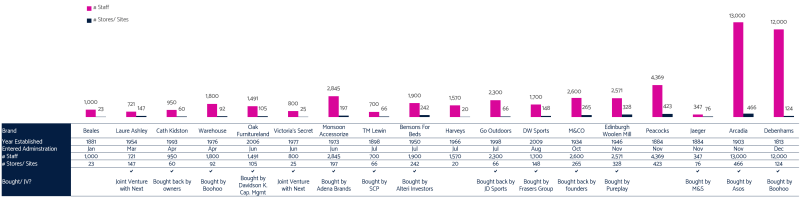

2020 sadly saw the failure of brands that have been a staple on British high streets for years, centuries even, in the case of Debenhams and Arcadia. These were brands with heritage, stores on every corner, and millions of customers coming through their doors each year. We know bricks have been increasingly eroded by clicks since the millennium. However, the Covid-19 pandemic, which has seen the total closure of the physical British high street for weeks on end, has catalysed the online shift. The trend of e-commerce growth and the decline of high street footfall has had the biggest effect on those retail brands with expansive physical store networks, over-leveraged debt, heavy staffing, or cultures which hadn’t moved with the times. Putting the below brands into administration risked over 50,000 jobs, and nearly 40,000 remain with no employer. Furthermore, 3,000 stores were put at risk, with some still in the hands of administrators.

Whilst we cannot change the outcome for these brands already lost, we wanted to try to identify findings that can help retailers for the future. We have examined statistics from those UK retailers which went into administration in 2020 and have provided three lessons we think can be learnt.

UK Retailers Entering Administration in 2020

‘‘Fifteen of the eighteen brands listed have been saved from administration, either through purchase, joint venture, or prepack deals’’

Two collapses and a cautionary tale

Debenhams’ collapse was not a surprise, especially since it had already entered administration in 2019. The unfortunate truth is that a concept that dates to King George III’s reign, risks not suiting modern shopping habits - a challenge all department stores are currently experiencing.

Arcadia’s vast store estate and mid-tier brand propositions of Topshop, Wallis, Dorothy Perkins, Burton and Evans made it a dominant high street presence in the nineties and early noughties. However, it struggled to remain relevant to younger generations. It lacked innovation of brand or range, and the digital presence of modern rivals such as Boohoo and Missguided.

Primark gave the industry a cautionary tale in 2020. It was forced to shut its doors, costing it an estimated £540m in sales in the first 16 weeks of lockdown, but an estimated £1.05bn if doors remain closed until 27 February 2021 as anticipated. While Primark stores are closed, online competitors such as Boohoo, Missguided and others are stealing customers, and growing profits which can be re-invested into new ranges and lower prices for 2021.

What can be learnt from these trends?

1 Embrace e-commerce at all costs

E-commerce is not going anywhere. The pandemic has nudged people into an “e-commerce first” mindset. According to Statista, only 23% of 18-24-year-olds purchase retail goods solely in bricks and mortar stores. Even in the over 65s bracket, it is still only 50%. Whilst set up costs remain high, and return rates can make long term viability challenging, omnichannel shopping is no longer optional. During the pandemic many brands have launched or adapted their offer to include limited online offerings successfully. Those brands without an online offer would be wise to take a cautious entry to e-commerce, focusing on a restrictive returns policy and realistic delivery commitments to protect against the longer-term trap of overcommitting to a model that their retail margins cannot sustain. Alternatively, with social media as an emerging and effective sales channel, it can be an excellent way to test the market before committing to a full online offer.

2 Reduce the financial risk inherent in a bricks first strategy.

If the market requires a change of business model, and for overheads to be cut, then retailers must change quickly and decisively. Debenhams entered administration in 2019, cut insufficient stores, changed little of its core business model, and a year later found itself back in administration. If a trend, like e-commerce, is unstoppable and irreversible, react decisively, but based on solid research. Changing pricing strategies which overcommit to unsustainable promotions, can support a more viable margin strategy.

Review business rates, lease agreements and renegotiate wherever possible. Business leaders have proven their ability to renegotiate rising rates. Doing so is critical to building a platform for future growth.

3 Listen, learn and adapt.

Retail brands need to challenge their market position regularly and ruthlessly. They need to ensure data pipelines allow a detailed understanding of customers across all channels, challenge every aspect of their user journey, and adapt accordingly. Retailers may have some success with a bricks and mortar focused strategy if they have a very clear brand and attractive core proposition like Primark. Still, it is not likely to be the right long term strategy for most brands. If like Debenhams and Arcadia, brands rigidly stick to the middle ground, ignore changing trends, and keep a large estate of expensive stores, with high debt ratios, it leaves them highly vulnerable to long term market shifts like e-commerce, but even more so to dramatic market shocks like Covid-19.

‘‘With recovery on the horizon, we predict significant innovation on the high-street of 2021, making up for lost ground in 2020.’’

To find out more about BJSS and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.