Blogs

Retail furloughs at record low

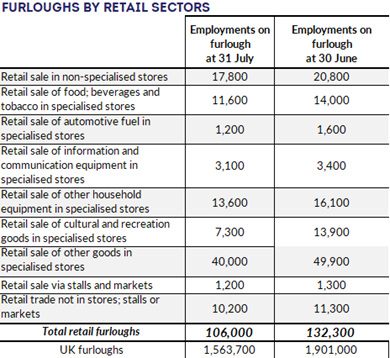

At the end of July, 106,000 retail workers were still on furlough, down from 132,300 at the end of June. This is the lowest number since the start of the pandemic. The UK as a whole also saw the lowest furlough numbers since the scheme was introduced, with 1.6mill furloughed workers at the end of July, down from 1.9mill the previous month.

By retail subsectors, the highest number of furloughs (40,000) were in the ‘Retail sale of other goods in specialised stores’ sector, which includes stores selling goods, such as clothing, jewellery, plants or antiques. The lowest number of furloughs (1,200) were in the ‘Retail sale via stalls and markets’ sector, which includes stalls of food, textiles or other goods. This confirms that some Non-Food retailers have had a harder time to recover since the economy reopened.

Retail furloughs account for 3.5% of the industry’s employment – below the UK’s overall figure where all furloughs make up close to 5% of the labour force. However, it’s difficult to interpret what this reveals about the industry. On the one hand, it is not clear what has happened to the workers that are not on furlough anymore – whether they’ve returned to their jobs in retail, or found other active employment, or were let go. Especially as starting in July employers had to contribute towards furlough payments. On the other hand, the fact that over 100,000 workers are still furloughed, months after the economy reopened, suggests both that there is still room for pent-up demand to be released and that the massive shift to online has already transformed the industry, such that fewer employees are needed.

Sector employment figures are due to be released next Tuesday. This data will shed some light on the industry’s state of employment. Currently, some retailers have expressed concerns about ability to retain staff in the run-up to Christmas. With retailers realising 30-40% of their annual sales during the last quarter of the year, it’s possible that staff has been retained to insure smooth operations during the coming ‘Golden Quarter’.

For the economy as a whole, these furlough figures complicate further the puzzle of the UK labour market. Companies in all sectors are reporting severe recruitment difficulties, but overall July furlough numbers are high for a labour market in full-recovery mode, and unemployment and inactivity remain above pre-pandemic levels.

As the economy reopened, economic activity recovered strongly in Q2, and that was mirrored in the highest jump in employment in Q2 since March 2020, with job vacancies reaching a record high and the redundancy rate climbing to its pre-pandemic level. As labour shortages are reported in many sectors, the question is whether these shortages are temporary, caused by a speedy economic reopening – it takes some time for employees to match with prospective employers, or will prove more persistent, owing to the pandemic permanently shifting the make-up of the economy and resulting in a lack of skills.

The Bank of England is closely watching the evolution of the labour market, as reported shortages have triggered higher wages, which would fuel long-term inflation. If shortages will turn out to be structural, the resulting pay hikes would lead the Bank to increase interest rates.