Blogs

Highest inflation ever recorded

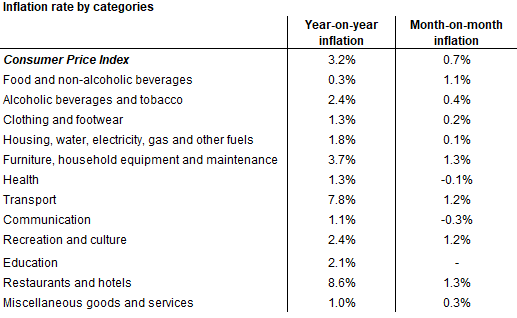

August consumer prices rose by 3.2% compared to a year ago, up from 2.0% in July and by 0.7% compared to the previous month. This is the highest annual inflation rate recorded since the series started in 1997.

The main drivers behind the yearly price rises were restaurant and transport prices. Last August, the Eat Out to Help Out Scheme and VAT reductions cut hospitality prices. As a result, prices this August seem much higher in comparison. High price rises for fuel, also an outcome of low prices last summer, and for second-hand cars – as the global car production industry was hit by a shortage of semiconductors, pushed transport prices up. Other goods have also seen significant upward pressures: Furniture & Household equipment prices were 3.7% dearer than a year ago and Alcohol &Tobacco goods were 2.4% more expensive.

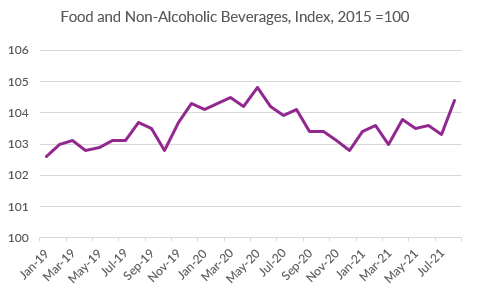

Food prices are climbing as well. On an annual basis Food prices rose for the first time since November 2020 and were 1.1% above July’s prices. That compares to the 0.6% rise seen in our August BRC-NielsenIQ data.

Prices will continue on their upward trajectory for the remaining of the year as pressures are set to continue. ‘Base effects’, where prices that fell last year are now returning to their 2019 level, are ongoing. The rapid increase in global demand for goods since the pandemic started led to bottlenecks in production and stretched logistics, increasing prices. The Bank of England estimates that annual inflation would swell to 4% by the end of the year, but that it would subside over 2022. The Bank judges these latter price rises to be transitory, as demand would fall and production capabilities would adjust.

However, given the current sizeable backlogs, it might take longer for these bottlenecks to clear. In addition, market prices for gas and electricity are seeing record surges to levels not seen since 2008 and 1990, respectively, suggesting longer-lasting pressures on prices. Moreover, severe labour shortages in some UK sectors have been pushed wages up. Wage inflation fuels longer-term inflation, as it's more persistent.

Retail prices are also likely to rise in the coming months. Upward pressures from the rise in global commodity prices, from food to furniture materials and chips, higher shipping and fuel costs will filter into final consumer prices. Besides, shortages of HGV drivers and of staff on farms to pick up produce or in meat processing plants, increased labour and material costs, adding to the already high pressures.