Blogs

Inflation reaches new highs

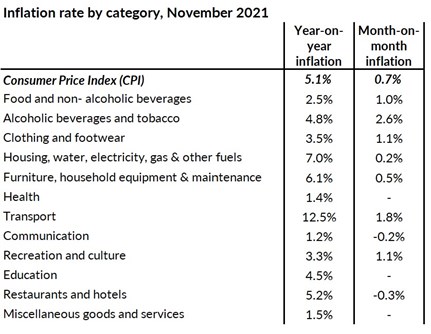

UK annual price rises surged to 5.1% in November, up from 4.2% in October and above market expectations of 4.8%. The Bank of England was expecting inflation to hit 4.5% in November and to surpass 5% in Q2 2022 only.

Higher annual prices for fuel (28.5%) and for second hand cars (27.1%) were once again the main drivers of inflation, as the global recovery pushed oil prices to record levels in recent years and the ongoing shortage of semiconductors meant that people shifted their demand from new cars to used cars.

Source: ONS, Consumer price inflation tables

Moreover, inflation is not limited to a few goods only, rather upward price pressures are present for almost all goods and services. Energy prices rose in October, so annual inflation figures will show a rise of 18.8% for electricity and 28.1% for gas until at least April, when the regulatory cap is likely to increase further. Food was 2.5% more expensive on the year, driven in part by price movements of goods traded globally, but also by labour shortages impacting the UK food manufacturing sector. For instance, November’s oils & fats prices rose by 9.2% and coffee, tea & cocoa prices by 4.6%. International vegetable oil prices were 51% higher on the year in November and 98% on a two-year basis, while coffee prices were 96% higher on the year.

Prices of clothing, furniture, household appliances, accommodation services and restaurants rose as well.

Judging by the rise in producer prices reported by the ONS or by the IHS Markit PMI, upward pressures on production costs have not relented, a testament that current inflation is not transitory.

All eyes are now on the Bank of England as its Monetary Policy Committee meets tomorrow to decide on interest rates. With annual inflation running at the highest rate in a decade, the Bank will need to balance its desire to support growth against the need to anchor the public’s inflation expectations to the policy target of 2.0%. In October, the British public’s expectations of inflation were also at the highest in over a decade, at 4.4% for the coming year.

The rise in the costs of living will dent budgets and confidence. November’s robust sales figures and the uptick in consumer confidence seem to suggest that households are upbeat about the holiday season, determined to make up for the ‘lost’ Christmas last year. However, this is likely to take a sharp turn in the other direction in the beginning of the year, once the holiday euphoria wears off and households will take a more cautious approach to spending, discretionary spending, in particular. The ONS calculated that prices for discretionary goods rose in November by 5.2% yoy, and for non-discretionary goods by 4.1% yoy.