Blogs

September prices rise by 3.1%

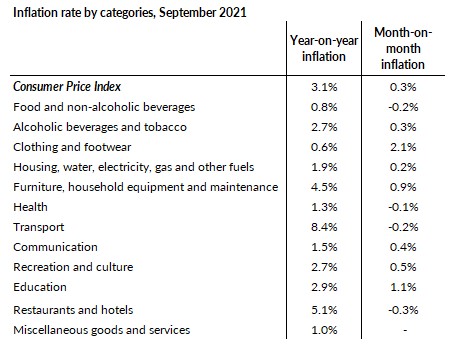

September UK consumer prices were 3.1% higher than they were a year ago. Yearly prices rose for all categories of the index, especially higher prices of fuel, second-hand cars, furniture and restaurants. Fuel prices increased by 17.8% compared to September 2020, as the worldwide recovery pushed oil prices to their highest since 2014. With the global car output significantly impacted by the shortage of semiconductors, demand for second-hand cars has climbed sharply, pushing prices up 19.2% on the year.

Food prices were also higher on the year, by 0.8%. Global movements contributed to the rise – international prices for vegetable oils have seen double-digit yearly rises for the past 16 months and those changes are filtering through into final prices. In September, oils & fats were 7.6% more expensive on the year. But fruits and vegetables were also pricier, due in part to the shortage of farm workers.

Source: ONS, Consumer price inflation tables

Inflation is likely to be closer to 4.0% in the coming months, as higher energy prices were passed on to consumers in October and food prices are expected to increase.

The combination of rising prices, especially the surge in energy and fuel prices, the end of government support programs and the forthcoming raise in taxes is likely to trigger a more cautious approach to spending from many households. Against the wider economic backdrop of labour shortages and the fuel crisis, consumer confidence has dropped in September, undoing the gains achieved during the summer. The outlook of personal finances over the coming year has deteriorated significantly, falling at the second largest rate on record. Heightened uncertainty will dampen discretionary spending, as households will increase their savings to create a safety cushion against future negative shocks.

Retail will undoubtedly feel the impact, as we entered the Golden Quarter. It’s during this time of the year that many retailers realise a sizeable share of their yearly sales. Reduced household spend will also hinder the UK’s recovery, already fraught with supply chains issues and materials and labour shortages.

The Bank of England believes that price rises are temporary, but it fears that inflation expectations will become embedded in households’ behaviour. As a result, it signalled that it’s ready to act to bring inflation closer to its policy target level of 2.0%. Markets expect the Bank will raise interest rates in December. But while this might tame inflation, it will also increase the cost of borrowing for firms and households, moderating the pace of growth. This shows the predicament of policy makers steering the economic recovery.