While lockdowns forced many physical stores to pull down the shutters, online retailers experienced unprecedented demand - and three-quarters of consumers say they will stick to their pandemic online shopping levels.

Despite the relative maturity of Europe’s ecommerce sector, it clocked some of the world’s most impressive digital growth last year. Ninety-six percent of consumers shopped online during the pandemic’s 2020 lockdowns – up 60% compared to 2019 – according to survey research for Checkout.com’s recent report, The New State of Retail.

And despite restrictions lifting, there is no indication that buying online is a lockdown fad. Almost three-quarters (74%) of consumers said they have no intention of significantly reducing their online shopping now that they can access high street stores again.

So, if ecommerce’s ability to power the bottom line is set to continue, and when it comes to the digital infrastructure of payments, what are the prime investment areas for growth? And how can retailers cut unnecessary costs, recoup missed revenue and exploit underused payment data to drive profit?

Seize the cross-border ecommerce opportunity

The ecommerce boom in Europe has triggered a surge in cross-border shopping, which is here to stay, and represents an opportunity for both UK and overseas merchants.

Last year this surge caught some retailers off guard, with 40% of those surveyed telling Checkout.com they weren’t prepared for 2020’s deluge of cross-border opportunities across Europe. A similar proportion (43%) admitted that they saw sudden demand from new markets where they were not set up with the right payment methods. This meant money was left on the table for competitors to enjoy.

Those retailers who will continue to grow are ones that are ahead of new markets and new consumers and are investing in the future, not just their current customer base. And that means working with partners who have solid experience of new markets to build out their payment offerings, as well as rethink their supply chains and bolster shipping services.

Payments data is a goldmine for retailers

No retailer needs to be reminded that data is the new oil. However, legacy payment systems aren’t offering decision makers the information they need to truly optimise revenue. Part of the problem is access to the information they need - six in 10 retailers said they don’t feel they receive enough payment insight to allow them to innovate their business models.

Data on failed payments is a prime example. The majority (70%) of retailers aren’t receiving this, so they have no idea why basket abandonment is happening. And even when retailers have access to the data, most (71%) aren’t receiving the support they need to make good use of it.

As the cost per acquisition for ecommerce ticks upward, and conversion takes a dive, no business can afford to lose any customer at the last hurdle.

In earlier Checkout.com research with Oxford Economics, data showed that the majority of European consumers take their money to a competitor’s website immediately following a declined payment. Quite simply, retailers who don’t tap into available data to explore reasons for failed payments are allowing their consumers to take their money elsewhere.

60% of eCommerce consumers will abandon their cart if they cannot pay with their preferred payment method.

Bricks and mortar still has its place – but on digital foundations

Whilst getting the digital house in order has become non-negotiable, it would be a mistake to underestimate the power of bricks and mortar stores, which are still important in a post-covid retail landscape that demands brand experience and real-life discovery.

But where online used to be seen as complementary to a retailer’s bricks and mortar offering, it’s now the other way round. Now, a retailer’s physical offering is underpinned by a comprehensive ecommerce offering. Four in 10 (39%) of consumers say that ecommerce needs to operate hybrid models offering physical experiences to help foster trust in the product and brand.

The importance of having a good offering both offline and online has accelerated as a result of the pandemic. Retailers that recognise the importance of innovating their offering will be the ones that stand out. Almost half (45%) of retailers told Checkout.com that high street shopping as we have known it will not die, but will be revolutionised by digital payments and in-store automation.

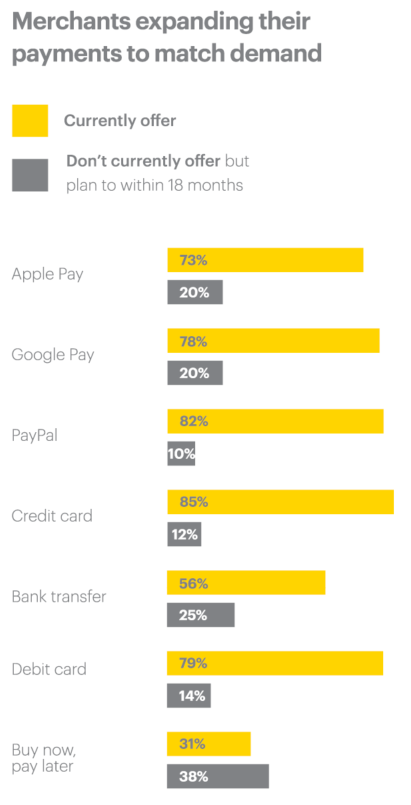

And talking about digital payments, these are continuing to rise in popularity and become preferred ways to pay: 80% of consumers intend to use a digital wallet such as Apple Pay, Google Pay or PayPal in the next 12 months and 40% plan to do so regularly.

The popularity of these digital payment methods demonstrates that there is a clear shift towards more consumers shopping online – and merchants are responding.

Take Homebase, for example, which recently selected Checkout.com as its new online payments provider – a move that enabled it to accept a wide range of payment methods, increasing choice, convenience and flexibility for its customers, and making shopping even easier for them.

71% of eCommerce merchants do not receive consultative, advisory and strategic support from their payment partners.

Changing consumer expectations requires innovation

The experiences of people and businesses through the pandemic and lockdown have been many and varied, but one thing is clear: consumer expectations of retail have transformed.

Many ecommerce and progressive traditional retailers have tapped into shifts in consumer behaviour online, and thrived. As physical stores reopen their doors again, and consumers seek out physical interactions, ecommerce retailers need to adapt once more to stay relevant.

Those that will succeed in the next phase of ecommerce are the ones that continue to seize the cross-border opportunity, innovate as consumer demands change, and tap into the goldmine of data available to improve the customer experience and boost their bottom line.

To find out more about Checkout.com and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.