COVID-19 has changed retail significantly and all signs indicate that some of these changes are here to stay. Despite this, the pandemic has provided new opportunities for retailers to embrace change and accelerate their omnichannel strategies.

One key change lies in the expanded role of stores in digital transactions – including Ship from Store, Click & Collect, and Kerbside Pickup. So, while stores have been challenged to drive sales in sanitised environments with capacity limitations, we have layered in a whole series of new activities. Optimising labour spend to incorporate these expanded digital activities, as well as accurately forecasting and scheduling them, has become critical. The goal, however, remains as before. Thrill customers by delivering the best possible brand experience and service.

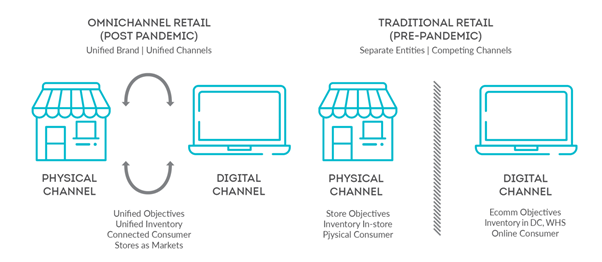

Physical and digital shopping have merged like never before. Creating blurred lines between channels. How we measure customer spend across channels will now be the ‘new normal’ in determining a brand’s overall performance. Understanding how consumer behaviours shift and acknowledging their shopping preferences and buying journeys will enable retailers to up their game by allowing them to make wise investments based on what consumers prefer.

Physical and Digital Pre & Post Pandemic

The logic is simple: connected consumers expect connected channels. Retailers need to be where their customers choose to shop, offering a seamless customer experience no matter what. Retail teams are adapting by starting to look at the total sales impact of their combined channels.

For years, these teams, whether offline or online, have been operating as separate entities. Each of them with different sales objectives, different inventories, and arguably, competing against each other for the same consumer. Historically, physical channels were only recognised by their day to day in-store sales. Conversely, e-commerce was available to serve and sell to their customers 24/7. Brick and mortar and online elements were not running as a single unified brand. The overall brand experience varied across channels, and sales efforts which may have started in-store but finished online were not factored at all into the store’s overall performance.

The changes we have seen in consumer behaviour over the last five years have accelerated since the onset of COVID-19. After the initial lockdown, stores continued to see historic drops in traffic, but the value of each customer entering a store had increased.

Continuing to measure each channel spearately often means the store only sees one piece of the story.

—David Loat

The Right Way to Experience a Brand: Converging Physical and Digital

Retail executives need real-time visibility of their omnichannel performance to understand how their customers are spending and what their holistic buying journey looks like. Digitally native retailers quickly understood the need for physical stores and the important role they play within a market. They started measuring how their new footprint affected their e-commerce sales by regions and vice versa. They have acknowledged the ever-evolving needs of today’s consumer and that the real value stores bring to their business goes far beyond traditional brick & mortar retail.

‘Stores as Markets’ Is Here to Stay

At StoreForce we refer to the convergence of physical and digital channels as ‘Stores as Markets’. ‘Stores as Markets’ reflects the opportunity to measure the influence that physical locations have within a trading area and, therefore, the overall success of a retailer’s brand. Ship from Store, click & collect, and kerbside transactions impact store operations in areas such as staffing, non-selling activities, or labour hours allocated.

In a recent interview Chris Noble, Managing Director StoreForce Europe, highlights the need of having a ‘Stores as Markets’ strategy. He suggests three key things retailers should keep in mind when creating their own ‘Stores as Markets’ strategy:

Retailers should apply the geographic location to every digital transaction, attribute it to a specific store, and credit the store for the efforts that have occurred in-store to support the online business.

How much available staff capacity does each store have in their base hours plan to support tasks created from digital demands such as online chat requests or ship from store? Retailers can better utilise their labour in times where their associates are less busy serving customers – being able to accurately predict future available capacity allows a retailer to optimise spend and reduces the need to fund these growing activities with net new spend.

Retailers must aim to have their best people working for them at their peak hours. Recognising their overall contribution is critical to retain their top performers.

Think of it this way – your physical store remains your most important brand touchpoint, and it influences your customers spend across all channels. As raw traffic numbers decline, and the ‘pure’ brick & mortar sales evolve into digital transactions, sharing only your physical store results with store and field leaders will make them think you are going out of business – when exactly the opposite is true!

By measuring sales by channel within a market area, you can see the percentage of sales being generated by both channels. You can also analyse if overall comp sales within a market area are growing. Continuing to measure each separately does not provide the insights to understand if a market area is growing or shrinking, and often means the store only sees one piece of the story. To truly win at omnichannel you need the stores to embrace it and encourage seamless shopping for their customers. By removing the channel divide, you eliminate the internal competition that is holding your business back.

linkedin.com/company/storeforcesolutions

storeforcesolutions.com/eu/contact-us/

To find out more about StoreForce and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.