The retail sector has been shaped profoundly by technological change, but what is the retail employment and high street impact?

Rapid advances in technology are increasing automation, the use of artificial intelligence (AI) and robotics at a pace. While change and technological advancement is generally welcomed as a means of driving productivity, concerns exist about job losses as human work is replaced. However, reports of entire job roles and occupations being lost are arguably overstated. Firstly, not every task performed by humans can be readily automated, while secondly, higher productivity gained through technology and automation arguably frees up human resources to be invested elsewhere.

RETAIL IN THE FIRING LINE

The proportion of all jobs at high risk of automation in the UK is approximately 30%. By comparison, rates of wholesale and retail jobs at high risk of automation are considerably higher at 42%.

The British Retail Consortium (BRC) forecast that retail jobs will decline by 900,000 by 2025. Of the jobs lost, BRC estimate that the largest proportion, 370,000 jobs, will be due to automation. Of note, BRC predict that only 100,000 new retail jobs will be created by 2025.

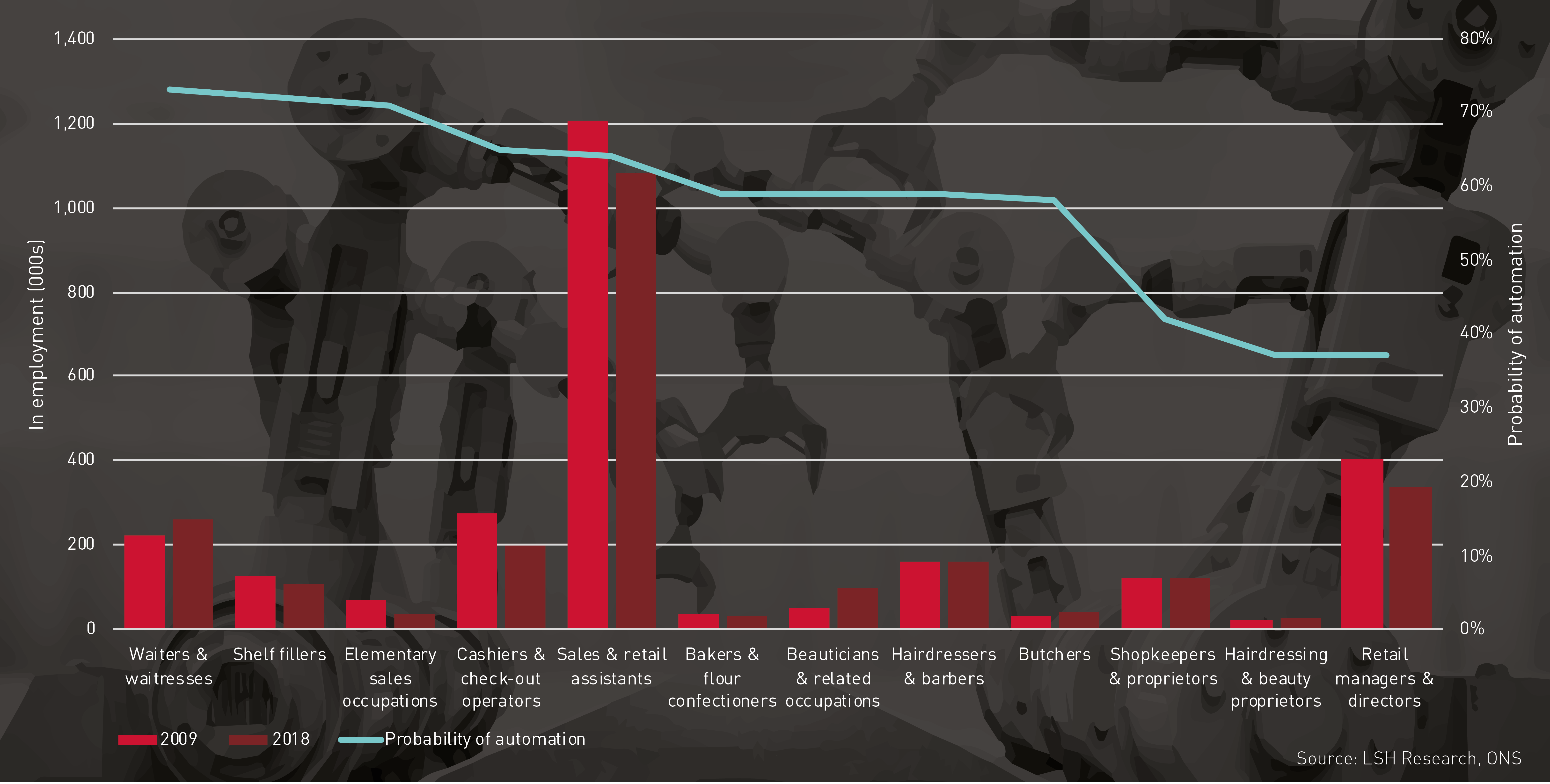

Waiters and waitresses, shelf fillers and elementary sales occupations were ranked by the Office for National Statistics (ONS) as the occupations at highest probability of automation. These occupations were not only the highest ranking retail occupations, but the highest ranked of all occupations.

It is logical to expect employment levels to be in decline in occupations ranked as most likely to be automated, as automation is already occurring. Yet, there has been a 16% increase in waiters and waitresses over the past decade. This is despite the introduction of self-service kiosks in fast-food restaurants and the likes of Deliveroo and Just Eat acquiring market share from mid-market restaurants.

ALL CHANGE

There is no doubt that retail will be further impacted with increasing automation. Robots are becoming more commonplace in warehousing and distribution, with Ocado and Amazon investing heavily to increase productivity and reduce cost. In-store, retailers are investing in AI to provide a more individual customer experience and to increase both dwell time and spend.

In turn, the nature of many retail jobs will change. Not every task associated with a particular job can be easily automated, and therefore most jobs will not be completely eliminated and higher value roles which require a human touch will emerge.

This changing nature has already been demonstrated with checkout operator roles in supermarkets evolving to include management of the self-service checkout bays. While there has been significant automation in supermarket shopping and checkouts, the current format cannot completely operate without human intervention. Even, the checkout-free format of future grocery stores, such as Amazon Go, require human employees to address customer queries and fix any tech issues.

RETAIL ROBOTS

The extent of automation and robots in retail will be heavily influenced by the specific setting and by what we do and do not want a robot to do.

Retail warehousing is already seeing the fastest growth in automation and robotics in the retail sector. Societal acceptance for replacing low skilled human labour with robotics in this environment is high, presumably because the majority of consumers do not have to directly interact with this automation.

It is likely to be acceptable to most to interact with a robot to gain straightforward information, but without any meaningful social interaction. To date, supermarkets have embraced a combination of automation and human labour, future supermarkets may be staffed by both robots and humans.

In a clothing store, particularly premium brands, however, quality experience and expert customer service from human interaction, will continue to be valued most highly. Automation and AI in this setting is more likely to take the form of smart fitting rooms and further harnessing of big data and analytics to target customers.

TECH VS HUMAN

Just because a job can be automated does not mean that the technology will be adopted, either quickly or at all. Even if a technological solution is feasible, the cost may be higher compared with human labour and therefore limit implementation by business.

To date one of the big plusses for humans over technology has been superior cognitive and social abilities. Future automation, however, will combine improved robotic dexterity and increased cognitive ability (through AI), increasing the likelihood of more cognitive tasks becoming automated.

Governor of the Bank of England, Mark Carney, points out that robots can replace hands and heads, but not ‘heart’. We have already seen examples where companies have removed automation to ensure their services provide ‘heart’. In 2015 Morrisons removed their self-checkouts because customers indicated they preferred the social interaction of a check-out operator. Online only bank First Direct, makes a virtue of not using automated menus and having humans answer customer calls, one of the things their customers tell them they love most.

THE FUTURE

Retail is primed for further automation and digitisation. The extent to which this is implemented will be setting dependant. We predict that automation will be significantly greater in retail warehousing than in customer facing stores, primarily this will be influenced by society’s level of acceptability of robotic interaction and their preference for human interaction.

Jobs will be lost, but there will be gains in the areas where new technology boosts demand, jobs will change and broadly they will become more highly skilled and better paid.

Humans and technological advancement can be complementary rather than divisive. New technology can boost productivity and new roles can make better use of human interactions.

CRIONA COLLINS

028 9026 9222

ccollins@lsh.ie

lsh.ie

To find out more about Lambert Smith Hampton and the services they provide to the retail industry, click here.

This article was originally published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.