Blogs

A bumpy road ahead for the UK

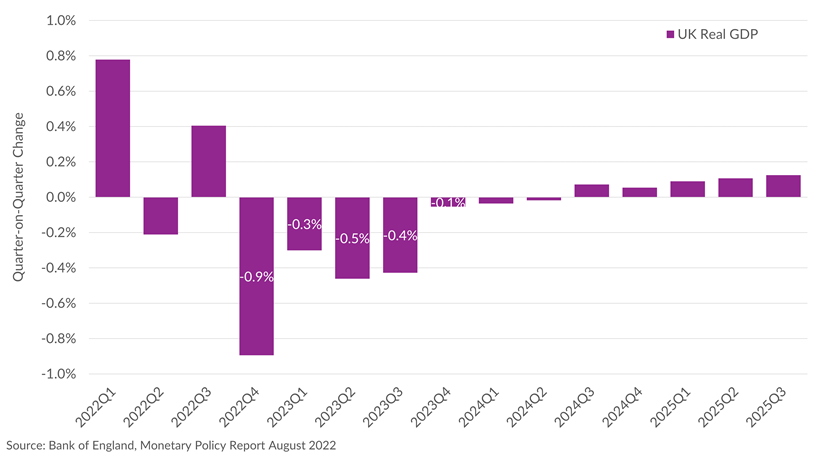

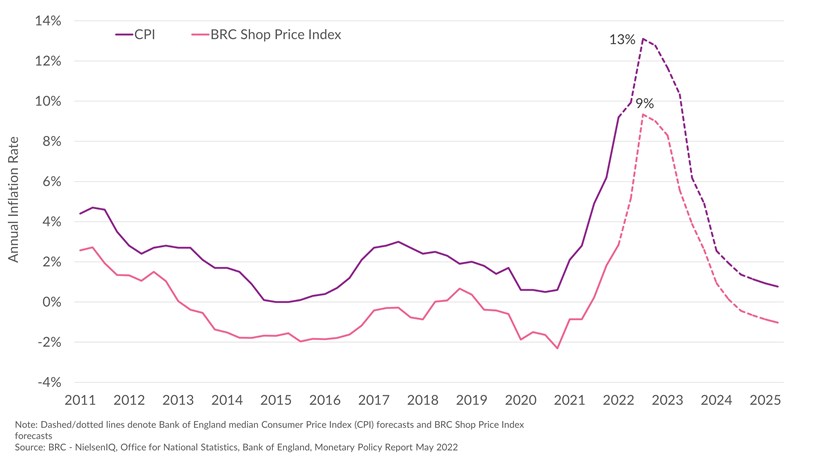

The UK is set for quite a winter ahead. Last week the Bank of England hiked interest rates for a sixth consecutive Monetary Policy Committee meeting. Not only was monetary policy tightened, but the UK’s central bank also produced some dire (to say the least) forecasts for the economy. Not only is inflation expected to peak above 13%, but the UK’s economy can expect ahead 18 months of economic contraction. The implications for the consumer? In 2023, British households see the sharpest fall in their living standards in almost a century.

The Bank of England’s projections suggests the UK heads into a technical recession during the first quarter of 2023. However, many households already feel as though they’re in a recession with consumer confidence at historic lows. Indeed, in the coming months, it is hard not to be pessimistic about the outlook for consumption - a fundamental driver of economic activity – as the UK’s economy is two-thirds service-based. With Ofgem’s price cap set to lift further in October, annual energy bills are anticipated to rise to an eye-watering £3,500 for the average household. To give you a sense of the squeeze this will place on household budgets, monthly direct debits will rise by close to £150 a month. Amounting to a further weakening of discretionary spending power, the consumer will continue to adopt a cautious pattern of spending.

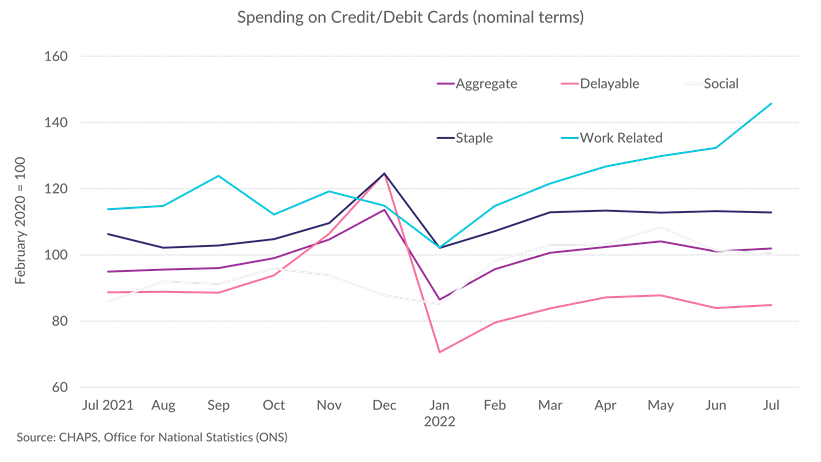

The CHAPS credit/debit card spending data visualised below show the effects of inflation in stark terms. Note how the blue (fuel) line is above and beyond its pre-pandemic trend. Consumers are spending, but much of this is being consumed by high pump prices - often not a matter of choice for those commuting to work. Meanwhile, now observe the pink line (delayable) which is trending back downwards. Items of furniture, computers and cars are now expenditures increasingly being put off even further into the future, as consumers navigate a murky inflationary environment.

Our own figures at the BRC show that retail sales would have fallen even further if it were not for higher amounts spent on food items, driven by inflation. However, retail sales volumes are suffering as shoppers cut back where they can and reportedly adopt behaviours such as £30 supermarket spend limits at the checkout. Figures from the Bank of England suggest consumers borrowed £1bn on credit cards during June, a suggestion that many are becoming increasingly reliant on the use of credit to make ends meet.

These trends will intensify over the coming months as inflation reaches further peaks, driven by housing and energy costs as well as prices in supermarkets. Recent easing in global commodity price pressures and oil prices gives renewed hope that these goods have already seen prices peak. However, due to the delay between the passing through of producer prices to domestic consumer prices, we cannot expect a swift loosening of the inflationary squeeze. Moreover, inflation is set to remain elevated over the next 12 months and is projected by the BoE to be above the 2% target until 2024.

Retail businesses have experienced the same cost pressures as consumers which have eroded margins and led to a cautious consumer in the aftermath of the pandemic. However, the spectre of more aggressive action by the Bank of England in raising interest rates reduces disposable income further and therefore consumers’ spending power, thus slowing down the economy to heed inflation. This places businesses in a challenging environment - with waning consumer demand and supply-side cost increases – we’re likely to see even greater competition between retailers who are vying to create more value for their customers.