Blogs

Retail Sales Drop in July

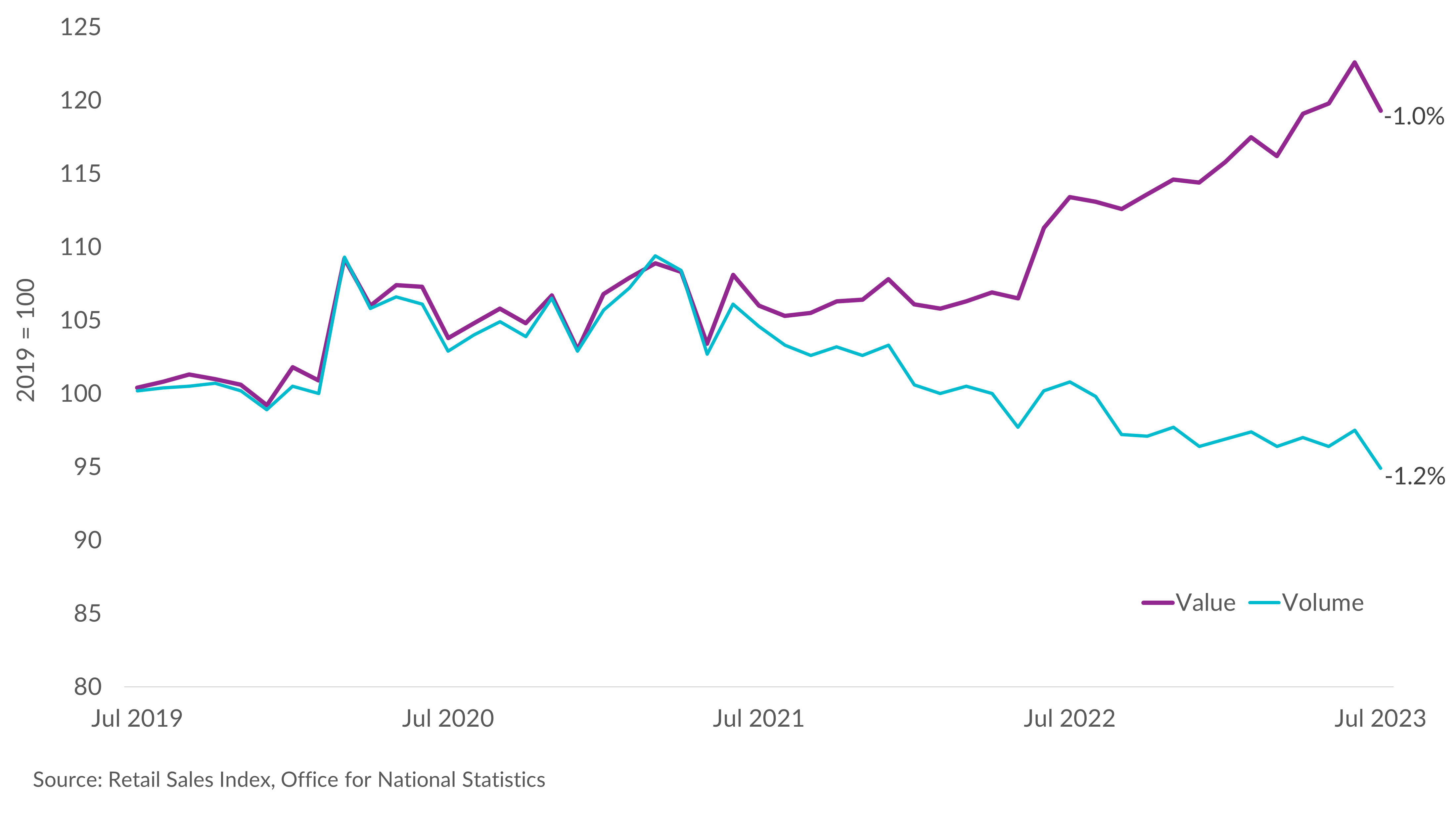

Retail sales fell sharply during July, with volumes declining by 1.2%, following a downwardly revised positive growth rate of 0.6% in June. Much of the strong performance during June was attributed to strong weather, though conversely, the sixth wettest July since 1836 had a huge impact on footfall, reducing the overall number of shopping trips.

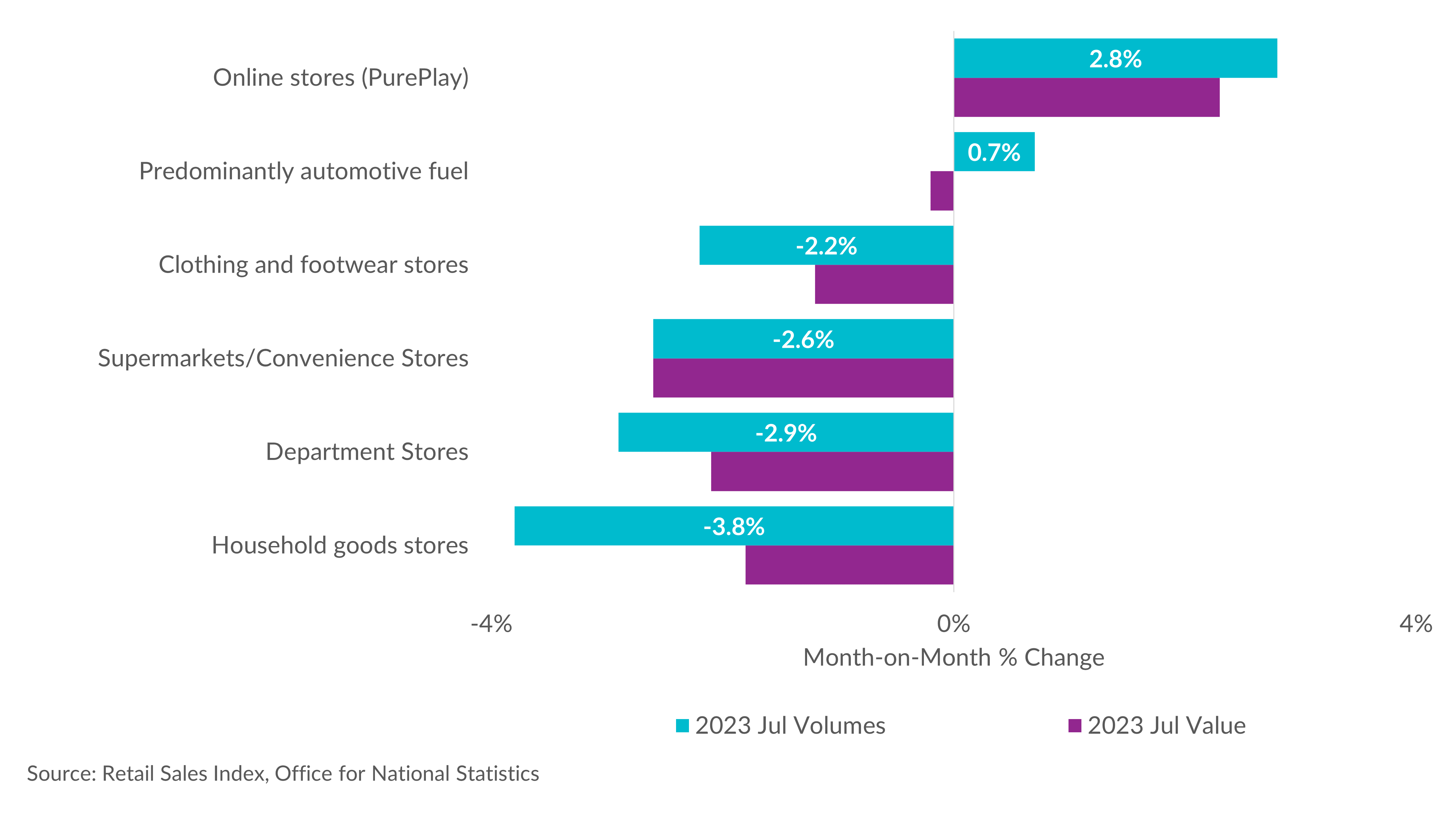

Volumes contracted across food and non-food stores, though to focus specifically on food: the high food inflation being witnessed (currently 14.8%), is having a clear impact on the physical quantity of perishable goods being purchased. More trading down, offers becoming less enticing and of course, fewer opportunities for barbecues all meant that less food was being purchased and volumes fell by 2.6% on the month.

Looking at non-food, this category was particularly affected by the poor weather. Fashion had a difficult month, and knowing what to stock and at what price proved no easy task. Thus far the strategy was to apply strong promotions. Other sub-categories to decline on the month were household goods stores, due to a decline in demand for furniture and lighting stores, likely another by-product of high inflation, this time in heavy durable goods. Similarly, department stores also witnessed a decline.

Two sub-sectors managed some volumes growth, one being other stores, seeing an increase in sales in art galleries and auction houses. The strongest performer this month was non-store retailing (PurePlay or online-only offering), with the bad weather shifting sales in-store to the internet. Online retailers reported to the ONS that the wet weather and various summer promotions helped boost sales. Indeed, the share of retail sales online rose to its highest since the UK came out of lockdown, to 27.4%. This is up from 26.0% in the preceding month.

The disappointing sales figures this morning were to be expected, following the publication of BRC – KPMG retail sales earlier this month, highlighting a significant slowdown in the value of retail sales. We expect some of these trends to have unwound this month in a lower share of online sales and a greater number of shopping trips.

Easing inflation should help reduce the downward impetus on volumes, though this is likely to yet take some time.