Blogs

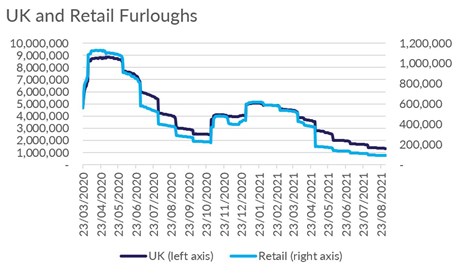

3% of retail workforce still on furlough

90,800 retail workers remained furloughed at the end of August, or 3.0% of the retail workforce, down from 109,000 (revised) at the end of July. There were 1.3mill workers furloughed in the UK as a whole, or 4.1% of the UK employed labour force, down from 1.6mill at the end of July.

These figures are difficult to tally up with developments in the labour market where the most recent data point to a continuous recovery. The number of payroll employees reached pre-pandemic levels in August and the number of vacancies passed the 1 million mark, with all industry sectors increasing their number of vacancies and the majority reaching record levels. The redundancy rate continued to slide in July to a similar level as in February 2020. However, the unemployment level, at 4.6% in July, is 0.6 percentage points higher than its pre-pandemic level.

In retail, there were 89,000 fewer jobs in Q2 2021 compared to a year ago (a decline of 2.9%), but the number of vacancies in the Wholesale and Retail sector has been rising over the past several months. In September, the volume of jobs advertised was 45% above the comparable period of two years ago.

There are few explanations for the mismatch between such high levels of vacancies and so many people still furloughed or out of work. On the one hand, employers, that had to contribute 20% towards furlough pay in August, might still be holding on to their workers because they expect demand to rebound further. This would mean most furloughed workers would return to their previous jobs, provided they have not already found a second job elsewhere, as was allowed under the terms of the scheme. If that was the case, we would see a positive impact on growth and longer-term economic recovery.

On the other hand, a more likely reason might be that the make-up of the economy has radically changed since March 2020, given there are labour shortages in most sectors, and furloughed employees do not have the skills for the jobs needed or find themselves in a different geographical area. With shortages of HGV drivers, of workers in fulfilment warehouses, or of workers with digital capabilities, the industry is confronted with both by a skill mismatch and a geographical mismatch.

Persistent labour shortages would put upward pressures on wages. Without a comparable rise in productivity, wage rises would fuel inflation. The Bank of England is closely monitoring the evolution of the labour market, attempting to assess the impact of shortages on longer-lasting inflation and the need to raise interest rates.