Blogs

UK growth runs out of steam

UK GDP growth slowed to 0.1% in October, down from 0.6% in September and below expectations of 0.4%. Supply chain issues and a decline in hospitality spend were behind the slowdown. A fall of 7.5% in food and beverage services drove the hospitality decline, while the wholesale & retail sector expanded by 8.1%. Production and construction activities shrank. The fall in the construction sector was the largest since April 2020 and was caused by significant price rises of raw materials, such as steel, concrete, timber and glass, due to supply chain issues.

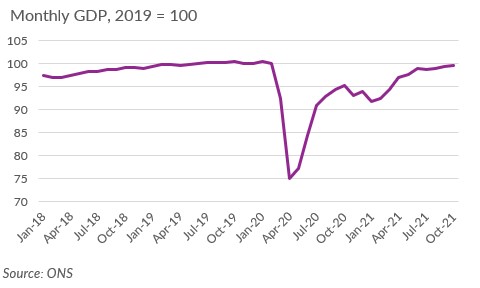

UK output, which in October was 0.5% lower than its February 2020 level, will surpass its prepandemic level by the end of the year.

Consumer spend was buoyant in November. BRC-KPMG retail sales grew by 5.0% year-on-year, as Black Friday deals and Christmas on the horizon fuelled holiday spend and UK credit card spend was 2.8% higher than it was in February 2020.

The IHS Markit November PMI suggested a stronger recovery for October, as activity in October and November ran higher than it did in the three months to September. Although it also reported that new business inflows accelerated in November, signalling robust output growth for the remaining of the year.

However, many headwinds persist for the longer-term outlook. The imposition of the government “Plan B” restrictions to curb the spread of Omicron delivers a new source of uncertainty for the future recovery. Although it’s expected that the negative impact on UK growth to be modest, the guidance on working from home will curtail spend in inner cities retail and hospitality outlets.

The new variant and the slow growth in October will complicate the Bank of England’s decision on raising rates. With annual inflation running at 4.2% in October, the highest rate in a decade, the Bank will need to balance its desire to support growth against the need to anchor the public’s inflation expectations to the policy target of 2.0%.

In addition, the prospect of high inflation over the coming year, ongoing supply issues and labour shortages will hinder the recovery. November’s robust sales figures and the uptick in consumer confidence seem to suggest that households are upbeat about the holiday season, determined to make up for the ‘lost’ Christmas last year. However, this is unlikely to last into the new year, with the rise in the costs of living and future taxes denting budgets and confidence. Supply chain issues are likely to continue into 2022 as well. This means price pressures on materials will continue unabated, which in turn will further put the breaks on growth.