Blogs

2,331 Retail Insolvencies Recorded in 2023

Recently published figures from the Insolvency Service revealed that the number of company insolvencies taking place across the United Kingdom reached all-time highs, at 26,607 (non-seasonally adjusted) over the whole of 2023. More specifically, insolvencies rose by 13.7% in England and Wales, 16.2% in Scotland and a considerably more muted 1.9% in Northern Ireland.

Whilst this number is high, it is reflective of an increasing number of businesses within the United Kingdom. The Insolvency Service reference the fact that the business failure rate remains subdued at 54 businesses per 10,000 during 2023, markedly lower than the peak failure rate of 95 businesses per 10,000 during the 2008/09 financial crisis. However, the rate was its highest since 2014, reflective of wider cost pressures that are threatening the viability of many businesses.

Indeed, these pressures are reflected in wholesale and retail trade businesses experiencing the second-highest number of insolvencies in 2023. This was higher than those in accommodation and food (a close third-place), but lower than those in construction, which accounted for almost 1 in 5 business failures.

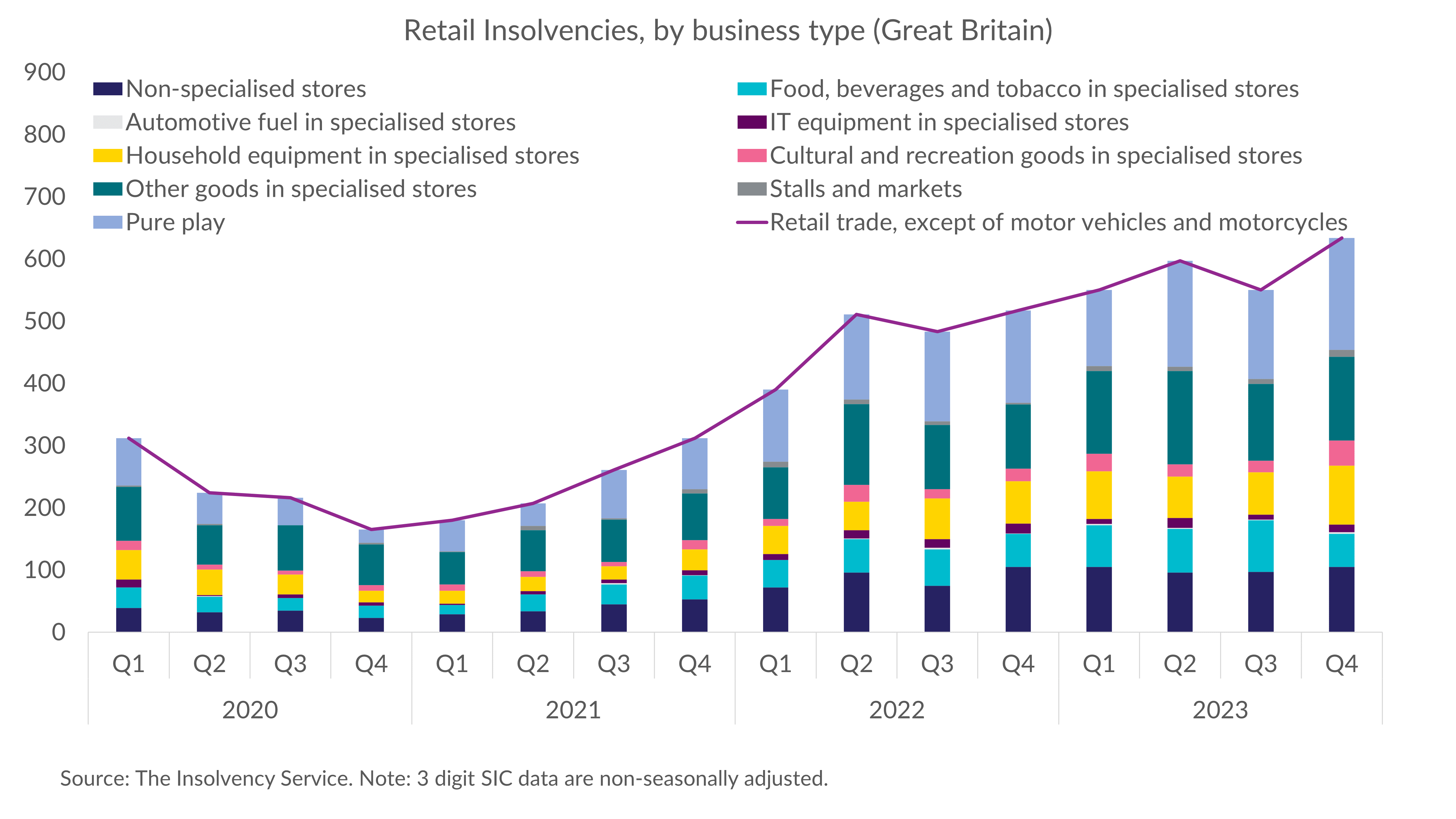

If we focus specifically on retail, there were 2,331 insolvencies in 2023, 22.6% higher compared to the 1,901 figure in 2022 and well up on the 960 figure in 2021. The industry had 14 companies enter a Company Voluntary Arrangement (CVA), up since 2022 and 2021 when there were 10 and 13 CVAs respectively.

Moving from the 2-digit Standard Industrial Classification (SIC) level down to the 3-digit SIC level, we can consider which types of retail businesses appear to especially be under pressure from broader economic headwinds. Pure play (online-only) retailers continue to account for the biggest share of overall retail insolvencies, followed by niche goods stores and department stores.

To summarise, insolvencies rose to their highest level as far back as data are available. Moreover, 2024 is likely to see the number of insolvencies rise, and the overall number may be higher than that seen in 2023. However, a silver lining is that the overall failure rate remains subdued, which can be seen as a sign of business resilience in the face of weakening economic growth and a consumer with less disposable income.