In a year like no other, Google data reveals the long-term shifts in consumer behaviour and how retailers can prepare.

In the retail industry, there’s only one certainty right now: change. But some shopping trends are starting to stick, which creates a significant opportunity for retailers who adapt their operations and innovate.

On Think with Google — where we explore the latest marketing trends and tips, tactics, and insights on digital transformation — we’ve been examining the accelerated digital adoption of the past year, its impact on consumer behaviour, and what that means for retailers and brands alike.

Now, as consumer spending shows signs of beginning to rebound, new Google data is providing valuable insights on the behaviours and trends with the greatest influence and staying power.

Below, we’ve pulled out five key shifts that we believe are most important for retailers looking to meet the changing needs of UK consumers — whether in-person or online.

The shift to online is here to stay

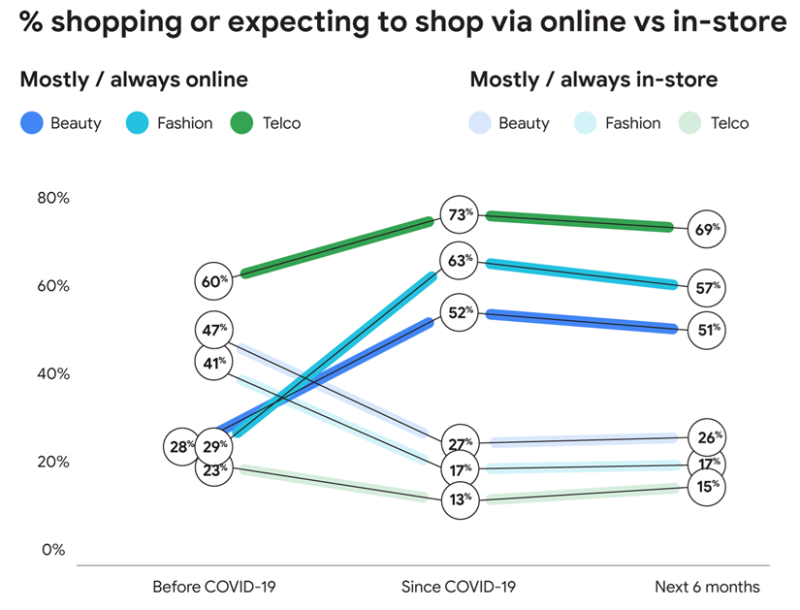

In a Google survey of 5,000 people across the UK, the percentage of consumers saying they will shop or expect to shop online versus in-store in the next six months remains markedly higher than pre-pandemic levels.1

Whether skincare, homeware, or fashion, this view is consistent across categories and demographics, pointing to wide and sustained changes in shopping behaviours.

With the biggest shift happening in shoppers aged 35 and above, it poses questions for high street retailers who have perhaps relied on older demographics for footfall. A rethink may be necessary in terms of how the in-store experience can complement, rather than compete with, online shopping — for example, with inspiration happening online and fulfilment and aftercare more suited to the physical store.

Window shopping is moving online

As the purchase journey changes, we’re seeing consumers move from searching for specific products online to seeking inspiration and ideas in the same space. Channels that retailers may have traditionally associated with the end of the purchase journey, such as search, are increasingly a place for discovery.

Testament to this, generic searches are up across the board in myriad categories, from “best electric car” (+80% year-on-year) to “vegan meals” (+58% YoY2,3). For retailers both big and small, it demonstrates the importance of showing up in these early points in the path to purchase and in using data and analytics to measure the impact of this activity.

This is especially true in assessing how store outcomes are affected by the investment that retailers put into reaching audiences in inspiration moments online. Engaging consumers through digital channels is an increasingly important tool for delivering in-store sales.

New brand loyalties are being formed

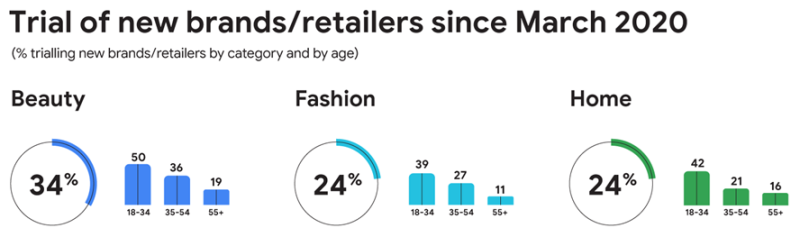

Our survey also shows that 1 in 4 clothing shoppers have bought from a new brand or retailer in the past year, and we see this same behaviour echoed across other categories, such as beauty and home.4

It’s clear that the pandemic has put past consumer loyalties to the test. In our survey, 75% of womenswear and 82% of menswear shoppers said they will continue to buy from these same new retailers over the next six months.5

As people spend more time online — and with more of a discovery mindset — there’s arguably never been a better time for challenger brands to make their mark. By investing in the most effective channels and using real-time consumer insights, such as Google Trends and the Rising Retail Categories tool, these brands can look to establish new, long-standing loyalties.

A seamless omnichannel experience is essential, starting with mobile

As consumers increasingly move between different retail touchpoints, both on and offline, a seamless omnichannel experience is only going to become more vital.

Nowhere is this need to meet rising consumer expectations, and provide a faultless user experience, more keenly felt than on mobile. During the past year, mobile usage has surged, with retail apps in particular showing significant growth.6 Failing to meet customer expectations here can be costly, with a one-second delay in mobile load times impacting conversion rates by up to 20%.7

For a successful mobile-first transformation, there are plenty of leaders to look to in the field. And, for those navigating the all-too-frequent corporate hurdles that arise when prioritising mobile, we have a Google handbook to help.

A retailer’s purpose has never been more important

The pandemic has triggered many consumers to reevaluate their relationship with brands, leading to prioritisation of those that more closely align with their own beliefs and values.

Case in point: global search interest has increased over the past year for terms such as ‘sustainability,’ ‘ethical brands’ and ‘Black-owned businesses’. As Nishma Robb, brand and reputation marketing director at Google UK, recently said, this is “a powerful indication that people are seeking to drive change, not just through campaigning but in the decisions they make as consumers”.

For retailers and brands, it is a huge positive to define a purpose that goes beyond making a profit. It not only creates an opening to drive meaningful connection with consumers but also presents a powerful opportunity to shape the world we live in for the better.

Lucy Ferguson is Head of Content, UK Ads Marketing at Google. Find more retail and marketing insights on Think with Google, sign up for the newsletter to get insights straight to your inbox, and explore an array of free tools in the Digital Marketing Toolbox.

Sources

1. Google/Trinity McQueen, U.K., Shift in Shopping, n=1000 consumers per category, Jan 2021.

2. Google Data, U.K., Jan—Dec 2018 vs. Jan—Dec 2019, All Branded Automotive Electric Searches Excluding Models.

3. Google Trends, U.K., Jan 2019 vs. Jan 2020.

4-5. Google/Trinity McQueen, U.K., Shift in Shopping, n=1000 consumers per category, Jan 2021.

6. The State Of Mobile 2020, App Annie, 2020.

7. SOASTA, The State of Online Retail Performance, U.S., Apr 2017.

To find out more about Google and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.