This article is provided by BRC Associate Member Mazars.

__________________________

The Financial Conduct Authority (FCA)’s Consumer Duty measures must be considered by retailers seeking FCA authorisation for their financial services products.

In the last few years, an increasing number of retailers have started offering financial services products to their customers. For those embarking on this new journey, demonstrating compliance with Consumer Duty might seem like a challenge to overcome when making their authorisation application.

The Consumer Duty, which came into effect on 31 July 2023, marked a shift by the FCA towards outcome-based regulation to protect consumers from harm.

What are the minimum requirements for authorisation?

The FCA authorisation process requires firms to demonstrate that they can meet standards known as ‘Threshold Conditions’. Firms must have:

- appropriate financial and non-financial resources.

- suitability to perform regulated activities.

- a UK office location.

- a suitable business model.

Firms must also comply with the applicable rules set out in the FCA Handbook, such as the twelve Principles for Businesses (PRIN). Principle 12 relates to the Consumer Duty.

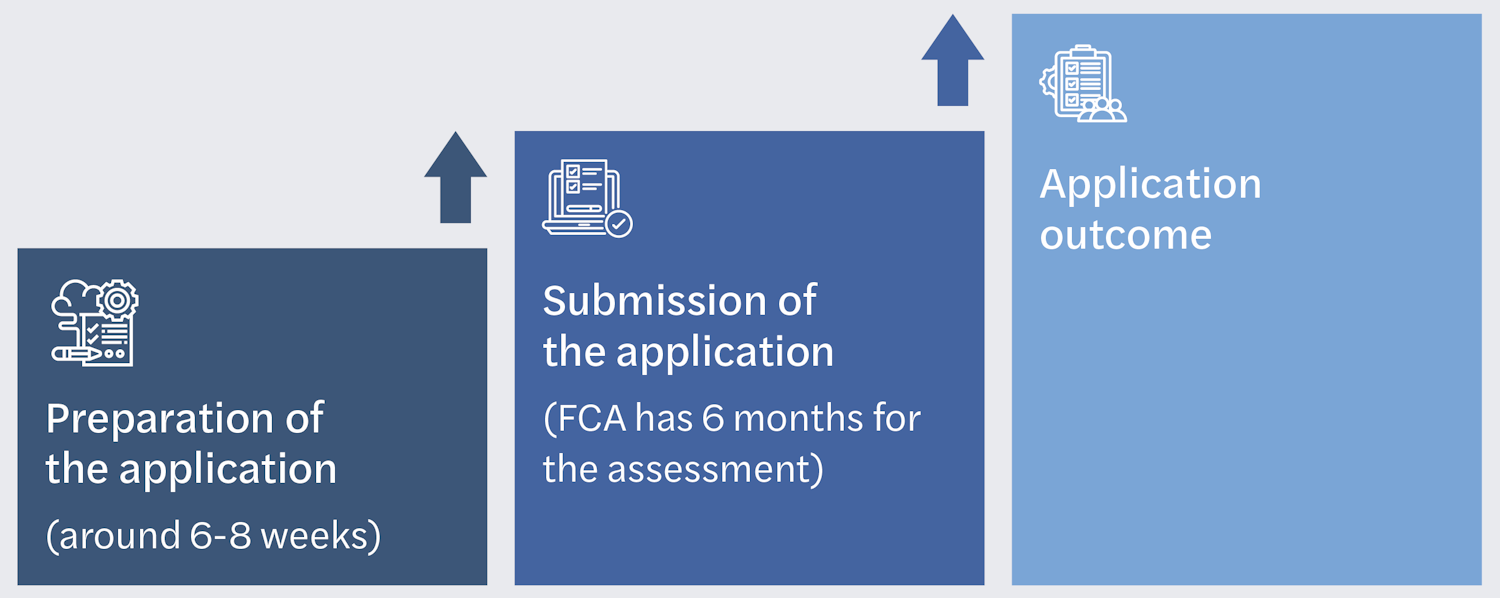

What is the application process?

The application for authorisation includes submitting an application form, a detailed regulatory business plan, and supporting documentation. The processing time for an application can take up to six months, and sometimes longer if the FCA requests further information.

Once the FCA has approved an application, the firm will be added to the Financial Services Register and assigned a Firm Reference Number (FRN).

Consumer Duty considerations

How can retailers incorporate the Consumer Duty in their applications?

Consumer Duty considerations should be evident throughout an authorisation application. The FCA provide a sample regulatory business plan (RBP) to support applications, which now includes specific guidance on the Consumer Duty.

The FCA will require evidence that firms have incorporated good customer outcomes into their culture, systems and controls, and the design and distribution of products and services.

Generally, ways which firms can evidence compliance with the Duty include:

- Fair value products and services designed to meet customer needs.

- Customer communications that are clear, fair and not misleading.

- Robust risk management frameworks and monitoring procedures.

- Support for customers, including vulnerable customers, and their financial goals.

Fair value

Retailers should design appropriate frameworks and complete fair value assessments for each of their financial services products. To properly assess value offered, retailers should carefully determine their target market. Understanding target market characteristics will enable retailers to maximise consumer benefits in relation to the costs of the products and services offered.

Costs and profit margins along the distribution chain should also be factored into the assessment. The FCA expressed concern that some Guaranteed Asset Protection (GAP) products are failing to provide fair value to customers. Retailers should consider the level of commissions paid throughout the distribution chain and ensure the amount can be justified.

Customer communications

Policies and procedures regarding customer communications, marketing and financial promotions are also important. Retailers should test and approve communications according to target market needs and characteristics.

The option for customers to split the cost of purchases through Buy Now Pay Later (BNPL) services is becoming increasingly prevalent. Though BNPL is not currently a regulated activity, it is an example of a high-risk area to consumers due to the additional charges that can arise from missed payments. To mitigate the risk of harm from financial products, communications need to be clear, timely and easy for the customer to understand.

Monitoring outcomes

Gathering good quality data to monitor and analyse customer outcomes is central to the Duty. Firms must establish reporting procedures for instances where poor outcomes are detected, whereby committees or the Board are alerted and the appropriate actions determined.

There is a concern that Big Tech retailers providing financial services might hold unfair advantage due to their access to large amounts of customer data and biometrics. This kind of information could be used to influence customer journeys according to behavioural biases. Retailers should be transparent in their authorisation applications (and with consumers) about the data they hold and its use.

Consumer Duty Champion

The regulator expects firms to select a Consumer Duty Champion at Board (or equivalent governing body) level. The role of the Consumer Duty Champion is to support discussion of the Duty, and challenge senior management on its embedding across the business.

Supporting information

Supporting information for an authorisation application may include a firm’s financial forecast, fair value assessment framework, product testing arrangements, and other policies, such as those relating to target market identification.

What are the next steps for retailers?

Retailers making an application for FCA authorisation should prioritise:

- Creating a strong business plan, tailored to their specific business structure, strategy and service offerings.

- Demonstrating compliance with FCA Handbook rules, including the Principles for Businesses and Consumer Duty.

- Performing a gap analysis against the FCA Handbook rules and taking action to address areas of improvement.

- Identifying and completing the relevant application forms and gathering the required documentation.

For more insight, get in touch with the Mazars Financial Services team.