What is CBAM?

The UK Government have recently announced that they are looking at implementing a UK CBAM by 2027, a year after the EU CBAM becomes fully operational in 2026. The Government have stated that the application of the UK CBAM will be linked with the UK ETS.

There is a significant overlap of the industries targeted in both the proposed UK CBAM and EU CBAM currently in force. However, the UK CBAM seeks to also include ceramics and glass, and to exclude electricity. Another area of divergence is that unlike the EU mechanism, the UK CBAM will not involve the purchase or trading of emissions certificates.

The UK CBAM will be applied to Scope 1 and Scope 2 emissions, both the direct and indirect emissions as part of a manufacturing process or when fuels are combusted onsite (electricity, heat, cooling, steam), and select precursor product emissions embodied in imported products to ensure comparable coverage with the UK Emissions Trading Scheme. As with the EU CBAM, Scope 3 emissions will not be initially included in the UK CBAM.

The Government has tried to target those products which are produced here to reduce competition for domestic businesses. It has also tried to align the scheme with the EU one to ensure consistency and reduce duplication.

What CBAM means for your business:

CBAM is part of the UK’s carbon reduction strategy. It is a tax on imports, based on their carbon emissions, to ensure UK producers who have taken steps to reduce carbon do not face unfair competition. Other countries have announced CBAM’s including the EU and Australia.

The CBAM is targeted to address the most carbon intensive products, including cement, ceramics, and glass. Much of the products in scope are likely to be used in your UK supply chains but some will apply to the finished products you import directly. The new taxes will apply from January 2027.

What do retailers need to know?

This consultation has been announced by HM Treasury. Of particular relevance is Annex A of the consultation which has the full commodity codes for products in scope. This is an extremely complex consultation, and we do not have the expertise to be able to answer specific questions on the calculation of the tax. We have posed generic questions which will help us make a submission detailing the impact in your supply chains and for your consumers.

Please send all responses by 3rd June 2024 to allow time to collate comments and submit our final response to Government.

We have engaged with HM Treasury who will secure BRC an invite into any information sessions on CBAM going forward and will update members accordingly.

What materials are targeted by CBAM:

The tax targets carbon intensive products by focusing on seven sectors:

- Aluminium

- Ceramics

- Cement

- Fertilisers

- Glass

- Iron and steel

- Hydrogen

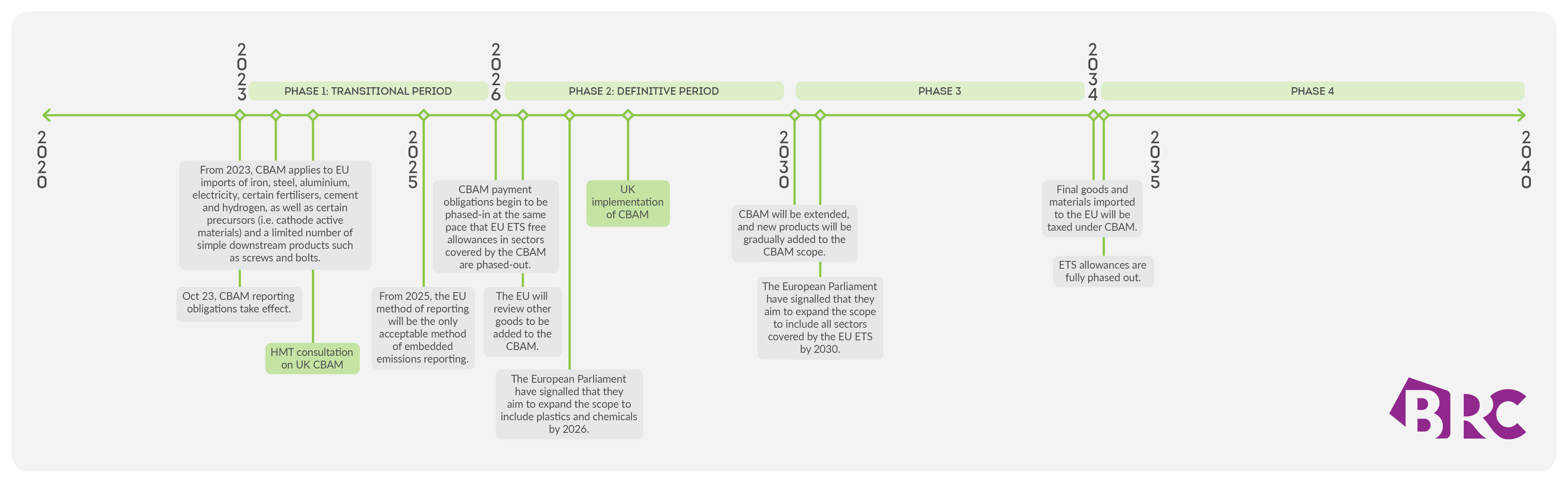

Timeline of Developments:

How to get started with CBAM:

- For more information, we have put together a guide to the consultation which goes into more detail on the calculation and payment of CBAM, read here.

- Look within to see what your business is already doing and continue to monitor and assess any legislative developments on the topic. Any businesses within the scope of both the EU and UK CBAM need to understand the differences in their requirements and identify opportunities for operational synergies.

- Educate yourself and your team. This includes understanding the reporting and regulatory requirements, as well as the financial and commercial costs, and the impact on the supply chain once the scheme becomes operational in 2027.

- If you are already preparing for the EU CBAM, ask yourself how you can harmonize data collection and reporting processes across the two mechanisms.

- And don’t forget, you can always speak to the BRC! We're here to support you where we can on your work on capturing and reporting carbon emissions as we guide retail’s approach to reaching our Net-Zero by 2040 goal.

For any queries, please contact Andrew Opie.