The dynamics of the UK labour market have been hard to get a read on in recent times. What was once considered a structurally tight labour market is now displaying unmistakable signs of loosening. In this blog post, we will delve into this morning's published figures and explore how the retail sector fits into this evolving narrative.

A Shift in Labour Demand:

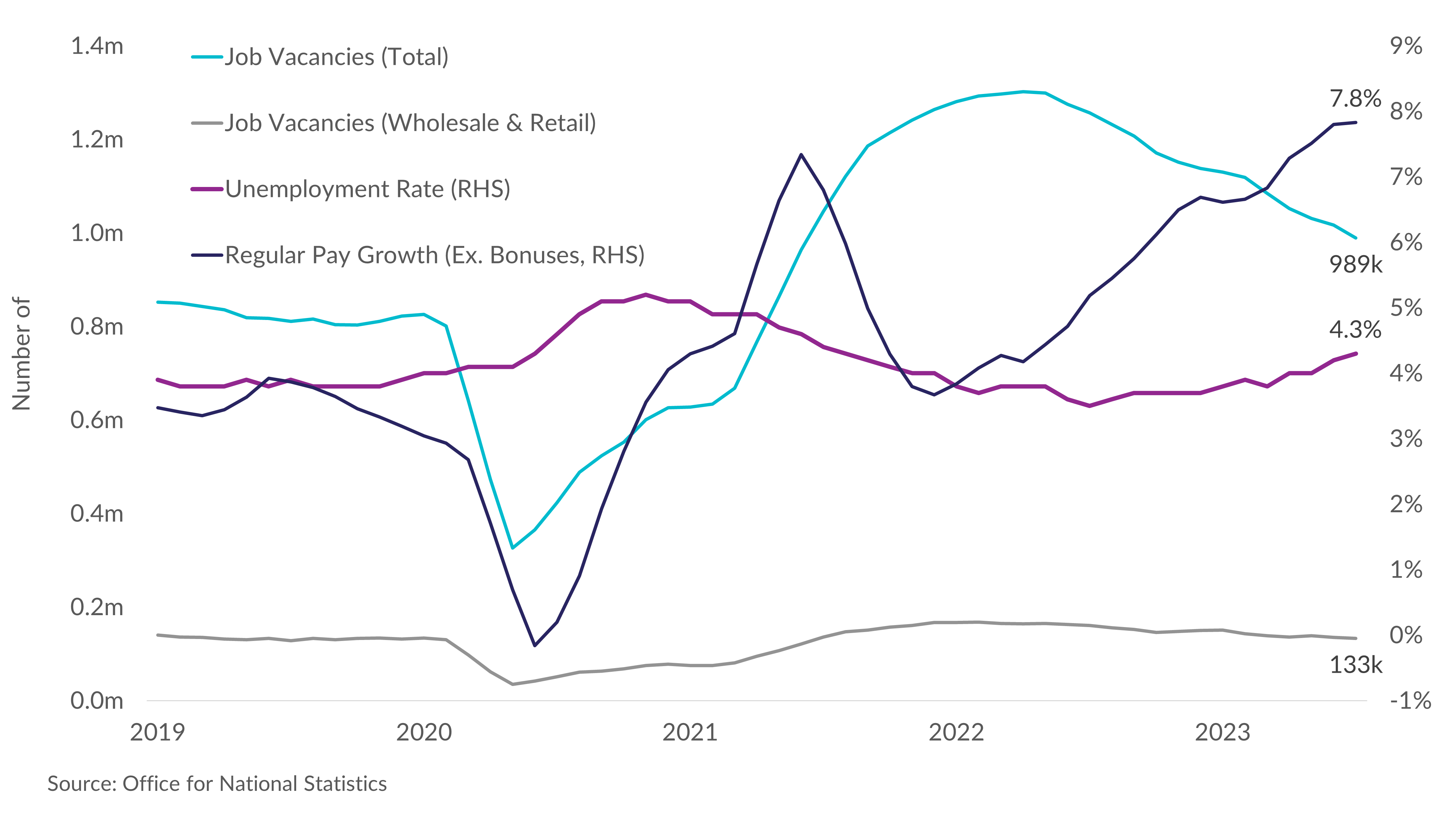

The labour market landscape has witnessed a significant transformation. Job vacancies, a key indicator of tightness, have fallen below a million, now only 20% above pre-Covid levels. This is compared to the peak in job vacancies of 1.3 million in April 2022, when they were 60% higher than pre-Covid levels. This sharp decline in labour demand over the past year suggests loosening in the labour market is well underway. Interestingly, the wholesale and retail sector witnessed this cooling far earlier, and job vacancies remain roughly in line with pre-pandemic levels. This suggests that the cooling down of labour demand had already occurred. The sector typically maintains a latent level of job vacancies, hovering around 130,000.

Unemployment on the Rise:

Unemployment rates have started to tick upward, rising to 4.3%. This increase is primarily attributed to a decrease in the number of individuals employed, though still actively seeking work. Notably, this unemployment rate was reached a year ahead of where the Bank of England had initially forecast, as outlined in the August Monetary Policy Report. One interpretation of these trends is that labour market outcomes are deteriorating more rapidly than anticipated, despite previous increases in the Bank rate. However, the Bank of England remains concerned about persistent wage growth and its potential impact on domestically-generated inflation.

Timelier Wage Insights:

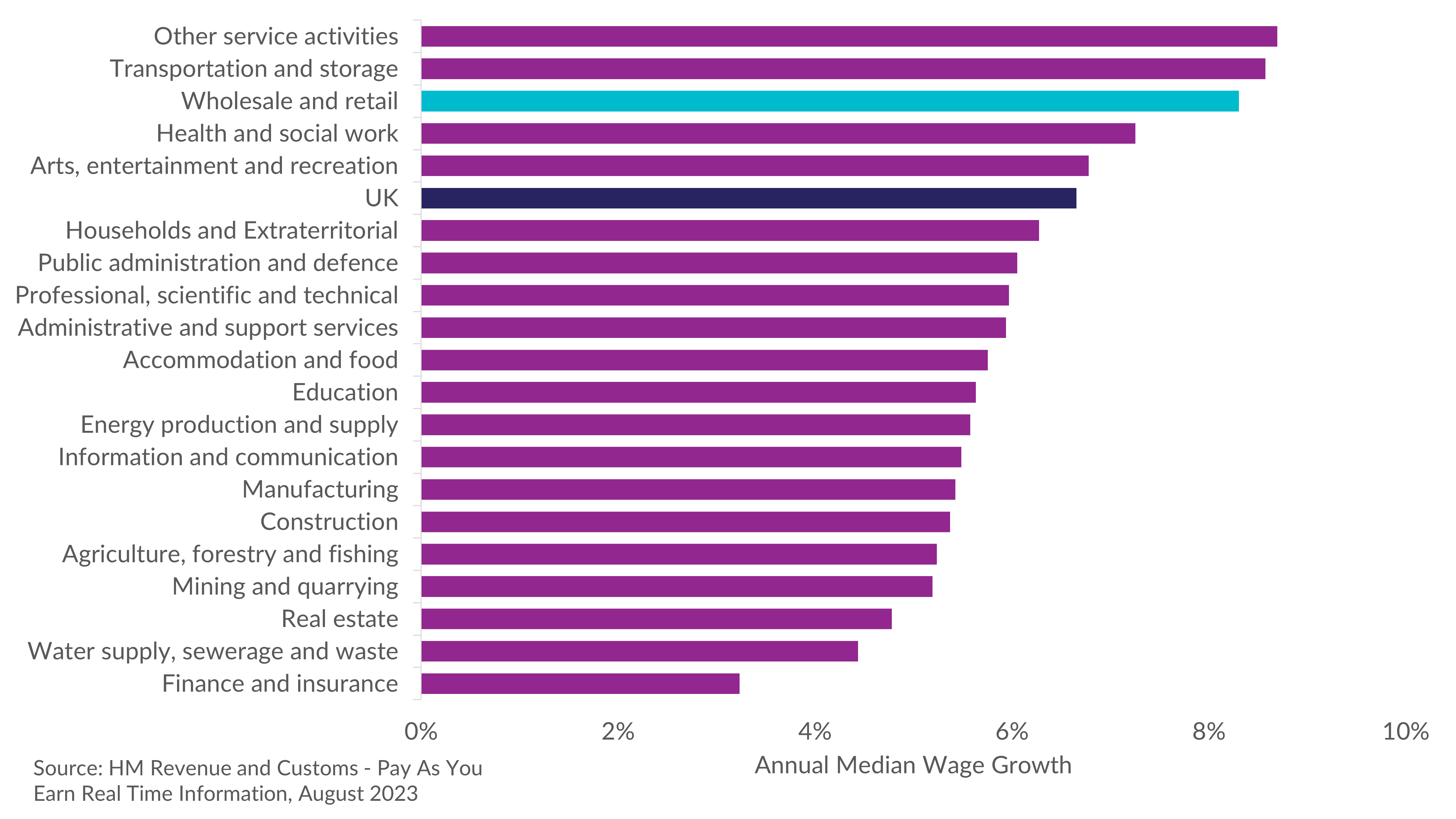

To gain a deeper understanding of wage trends, we turn to the Pay As You Earn figures, which provide timelier wage data from HMRC. As of August, median wage growth continued to ease, indeed falling on the month, registering a year-on-year increase of 6.7%. The retail sector's median annual wage growth remains strong, and has consistently had one of the highest growth rates for the past six months. Sectors such as finance and insurance, as well as energy, have now seen a considerable deceleration in wage growth. In contrast, arts, entertainment, and recreation, along with transport and storage, have witnessed accelerating wage growth.

Workforce Jobs and the Self-Employed:

Recent data on workforce jobs indicates a slight decrease over Q2 2023, with a similar trend evident in the retail sector. A recent rise in redundancies has contributed to a decline in retail jobs. Moreover, a substantial decrease in the number of self-employed roles has played a pivotal role in the overall quarterly decrease in total jobs. The chart below looks at the four-quarter moving average of jobs in both retail and the overall economy, to provide a smoother picture of trends in jobs.

The Road to Stagflation:

Labour market statistics continue to present a mixed picture. However, it is becoming increasingly likely that the UK may be headed towards stagflation, a challenging economic scenario characterised by stagnant growth, inflation and heightening unemployment. These evolving dynamics present a conundrum for the Monetary Policy Committee, though market expectations remain for one further 25 basis point interest rate hike, increasing the Bank Rate to 5.5% at their next meeting on the 21st of this month.