Understanding how the consumer feels and reacting accordingly should be a top priority for UK retailers going forward.

Over the years, UK retail has seen many consumer faces and adapted to them all. But one of the greatest challenges the industry faces today is dealing with the latest evolution - the ‘anxious consumer’.

This is a UK consumer nervous about everything, from the financial impact of the COVID-19 pandemic to the health risk posed by a potential second wave.

Their uncertainty around the future means concern is high. When polled for the June EY Future Consumer Index, over the period non-essential stores reopened in the UK, more than half of UK consumers (52%) said they believed it will take a year or more for the country to recover. Just under half (48%) said it will take months or longer for the way they shop to return to normal, despite the ending of lockdown, and 49% said the way they shop over the next one to two years will change.

Confidence may well improve over time as UK consumers settle into the ‘new normal’, but it is likely some degree of anxiety will remain regardless. For retailers, understanding and acting on these concerns and their long-term implications is key.

Action 1: Meeting consumers’ more basic requirements

Retailers need to understand the new needs of the anxious consumer – that of feeling protected, both physically and financially. They must also allay the nervousness of their staff.

Consumers want to feel safe when shopping - 63% of UK consumers say they will be more mindful of hygiene and sanitation when shopping instore over the next one to two years.

They also want value for money and to consume in a more purposeful way, so that when they do go instore it is with good reason. Affordability is now a top priority and the age of rampant consumerism, at least for the time being, has gone.

Companies will need to face an increasingly anxious consumer and reinvent their customer experience if they are to prosper beyond COVID-19.

Silvia Rindone

Where sustainability, luxury and personalisation were key pre-COVID-19 trends, today’s UK consumer needs are more basic, focused instead on product availability (53%), price (44%) and health and wellness (44%). Affordability and health also appear in the top three criteria for what UK consumers will value in five years’ time and should be key focuses moving forward.

Action 2: Focus on range and simplicity

Editing of ranges, services and experiences are crucial for retailers to deal with the anxious consumer now, as well as their changing future requirements. Social distancing and protection measures now in place in all stores have changed the instore experience entirely.

But while browsing may not be what it was and footfall comparatively low, it seems consumers are more determined than previously, with retailers reporting higher than normal conversion rates instore.

Where UK consumers are considering changing how they shop, more than half (59%) plan on consolidating shopping trips into less frequent but larger purchases over the next one to two years.

Action 3: Continued focus on digital

Digital came to the fore during lockdown as online shopping increased. Over two fifths (43%) of UK consumers expect to shop more online over the next one to two years for items they would have previously bought instore.

Consumer anxiety may mean that online shopping continues to grow more strongly than it may otherwise have. For others, longer-term changes in shopping behaviours may simply be the voluntary adoption of habits, preferences and attitudes imposed and normalised during lockdown.

Engaging shoppers via digital will be key both online and instore. Instore apps and digital payments help to overcome some of the challenges retailers face at critical moments for consumer experience, such as at the checkout, and will continue to be important for the anxious consumer.

Action 4: Understanding future consumer behaviour

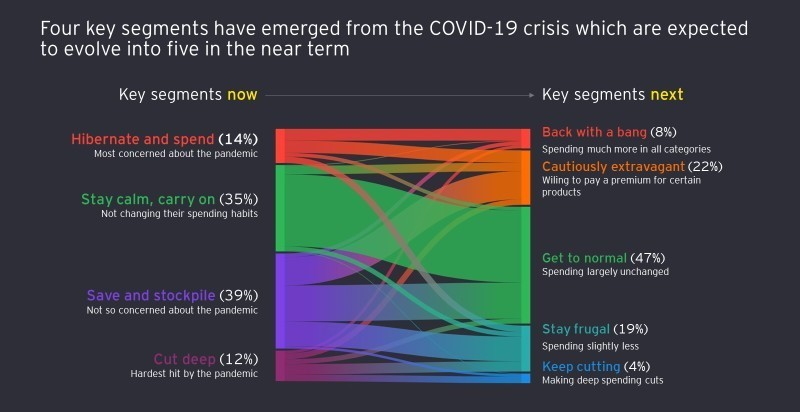

Perhaps the best way for retailers to serve the anxious consumer is to understand how they are likely to feel, behave and spend in the future. Our inaugural EY Future Consumer Index, surveyed at the height of lockdown in April, suggested that post-COVID-19 UK consumer segments would transition into five key categories. We have been tracking their evolution ever since.

When surveyed in June, the most dominant consumer segment is those focused on ‘getting to normal’. These were consumers who kept calm and carried on during lockdown with spending and mood largely unaffected. They account for just under half (47%) of UK consumers surveyed.

The next largest group, the ‘cautiously extravagant’, accounts for a quarter (22%) of UK consumers. They focused on saving and stockpiling during lockdown but are now expecting to spend more and could even be tempted by premium products as they look to treat themselves.

FIVE EMERGING UK CONSUMERS

- Get to normal (47%)

- Cautiously extravagant (22%)

- Stay frugal (19%)

- Keep cutting (4%)

- Back with a bang (8%)

Source: EY Future Consumer Index (UK insights), June 2020. Percentages are rounded to nearest whole number.

EY Future Consumer Index methodology

The EY Future Consumer Index is based on regular global surveys conducted exclusively for EY. The surveys (currently covering 18 countries) are designed to provide a 360-degree perspective on the changing consumer and cover behaviours, sentiment and intent. This article references 1,012 UK survey respondents during the week of 8 June 2020.

One in four UK consumers (19%) will ‘stay frugal’, are price-focused and unlikely to increase discretionary spending in the near term. They are likely to have also saved and stockpiled during lockdown.

However, some 4% of UK consumers will ‘keep cutting’, despite already making deep cuts during lockdown. These are those consumers most impacted by the economic implications of COVID-19.

The smallest, but perhaps most exciting segment, is the ‘back with a bang’ group. Only accounting for 8% of UK consumers, they are largely younger, but the most willing to spend, both during and after lockdown restrictions have lifted.

It is their pent-up demand and how they behave which could perhaps help to reassure other consumers that it is safe to spend again.

Whatever the coming weeks and months bring, one thing is for certain. Building trusted relationships between retailers and consumers, as well as retailers and their staff, is going to be critical to reducing anxiety levels. For the latest global EY Future Consumer Index insights, visit: ey.com/futureconsumerindex

SILVIA RINDONE

// Contact

// LinkedIn

// ey.com

Disclaimer: This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Member firms of the global EY organisation cannot accept responsibility for loss to any person relying on this article.

To find out more about Ernst & Young LLP and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.