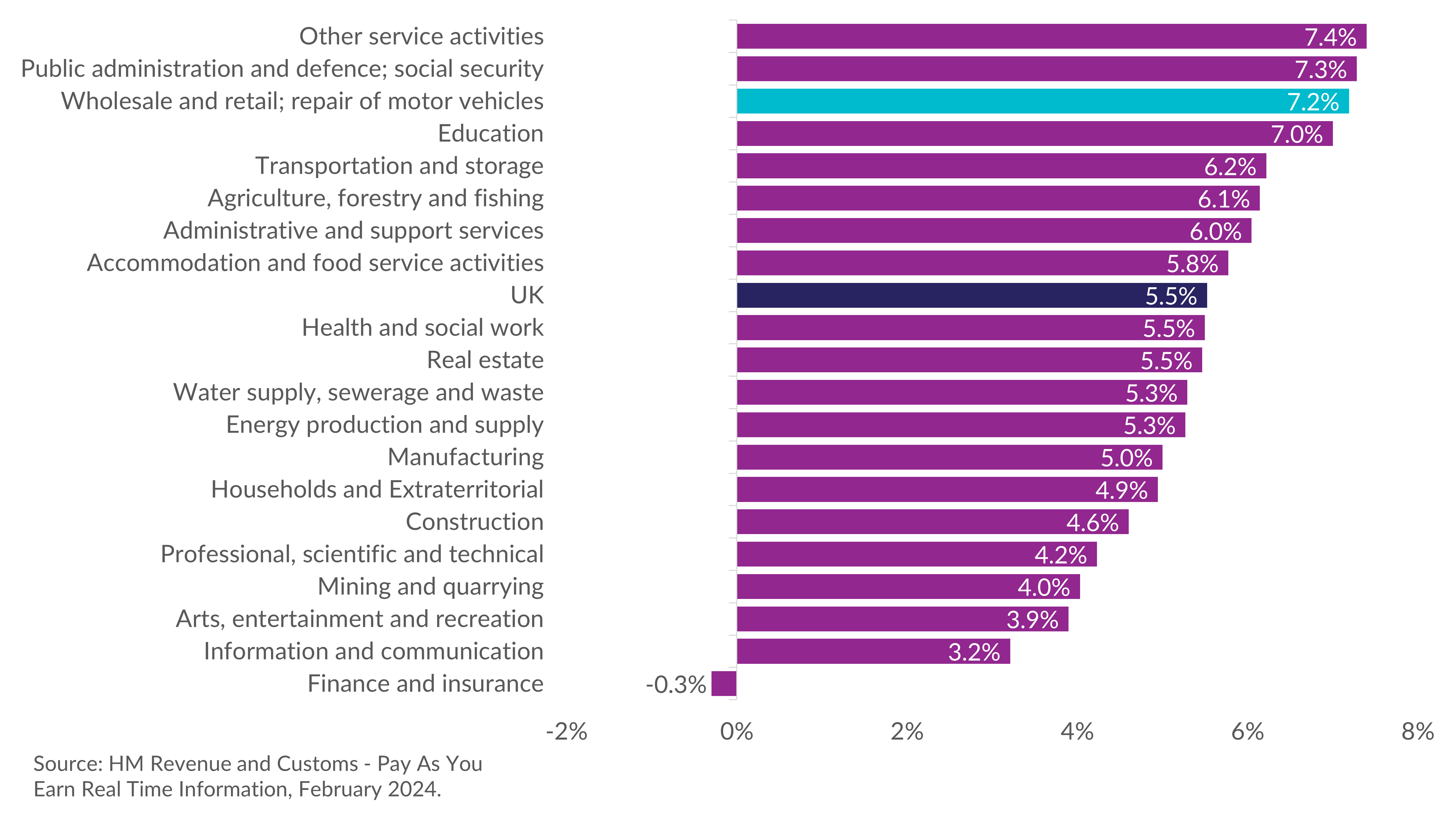

Retail occupations have seen some of the fastest pay growth across British industry. The latest HMRC data suggests that retail pay rose by 7.2% last month compared with the previous year. This puts retail in 3rd place in the pay growth rankings. These heady increases have been a feature of the past two years and have meant an inflation-beating trajectory, even before the National Living Wage uplift due next month.

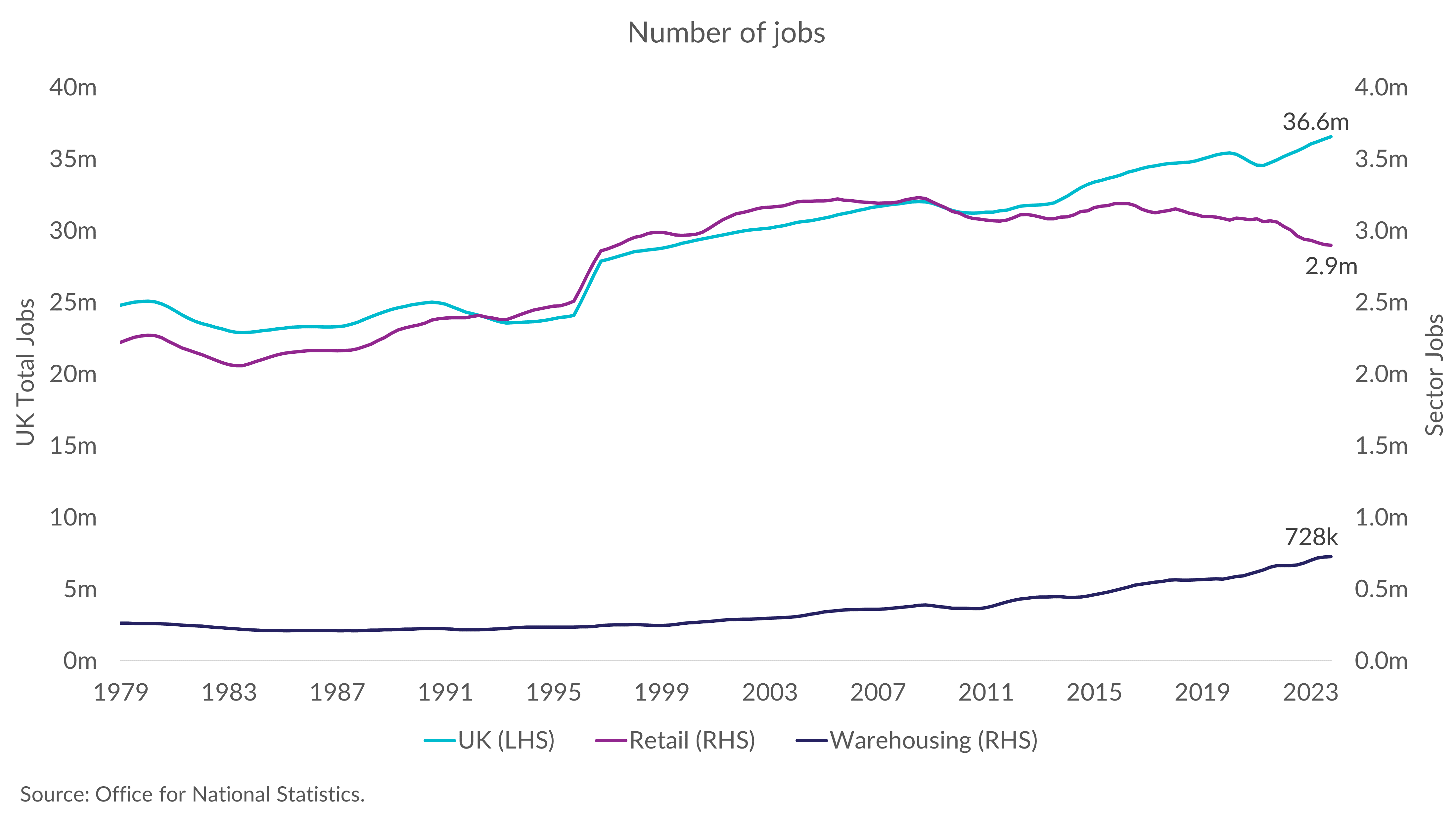

How has the industry responded to these trends? Recently published figures provided us with a startling statistic, that the four-quarter moving average of retail jobs (including self-employment as well as typical employment) fell below the 2.9 million mark for the first time since 1997. As employment typically follows the seasonality of retail sales, we always see a jump during the Golden Quarter. Looking at the rolling average allows us to more clearly see the downward trend in jobs.

How has the industry responded to these trends? Recently published figures provided us with a startling statistic, that the four-quarter moving average of retail jobs (including self-employment as well as typical employment) fell below the 2.9 million mark for the first time since 1997. As employment typically follows the seasonality of retail sales, we always see a jump during the Golden Quarter. Looking at the rolling average allows us to more clearly see the downward trend in jobs.

However, this marked reduction in the number of retail jobs is a sign of an industry becoming less reliant on labour. This trend is in stark contrast with the rest of the economy. The number of jobs in the UK reached a record high of 36.6 million, suggesting there are more jobs than ever before. The divergence of retail from the rest of the economy is easily noticed in the chart below, particularly from 2015 onwards.

The chart above also reveals the number of warehousing jobs being at record highs, now above 700,000, having been below half a million in 2015. The rise in online shopping and diversification of the retail offering has meant a reallocation of labour demand from in-store to in-distribution centres.

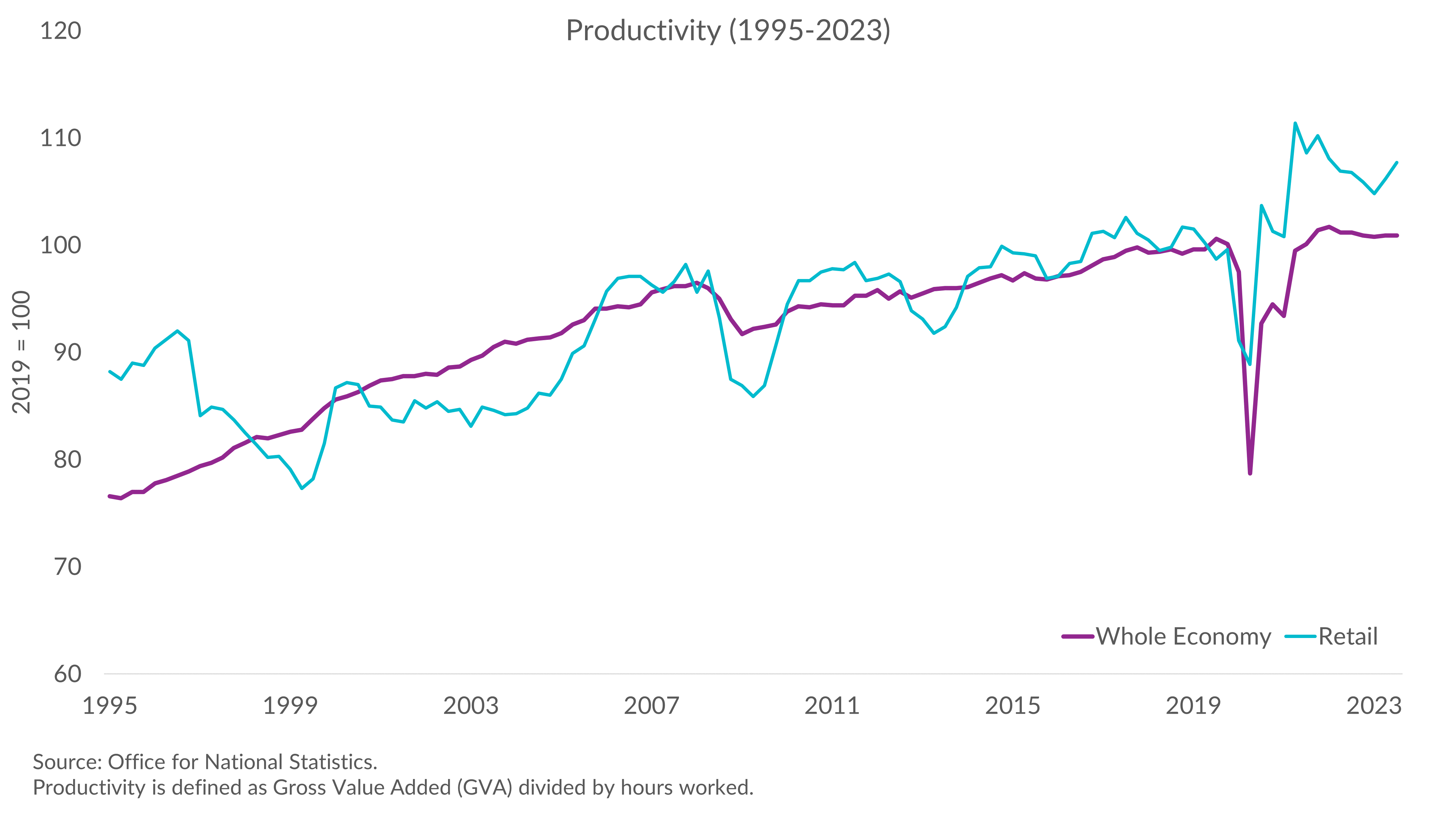

I have already mentioned that increasing pay rates as one of the drivers in reducing demand for labour, but it is also relevant to look at productivity growth. It is well known that productivity growth has lagged considerably in the UK, managing to grow only 4.6% since the Global Financial Crisis (Q1 2008 to Q3 2023).

Compare this with the 27.6% growth between Q1 1994 and Q4 2007, and you’ll notice just how sluggish growth has been since. In retail, growth over the same period was 12.4% and a slightly higher 12.7% since the Global Financial Crisis. Not only has productivity growth been more even and consistent in the retail sector, but growth has been well above the national average since 2008.

So the retail workforce is becoming more efficient, and this is reflected in labour productivity as well as the share of retail jobs falling from 10% to 8%, whilst retail GVA remains largely stable. However, it is also worth recognising the crucial role of warehouse operations for retailers, particularly for online fulfilment.

The one buzzword I’ve not yet mentioned is automation. The rise of self-checkout has initiated an efficiency in store-staff presence as the number of manned tills drops in favour of self-checkout and self-scan options. But that’s not the only type of automation resulting in labour efficiencies. The advent of Generative Artificial Intelligence (GAI) in Large Language Models (most notably ChatGPT) has also introduced innovations in website product algorithms as well as inventory management in warehouses, minimising human error.

Thus far, this integration of Generative AI has been largely complementary to labour, though, in the coming years, I expect its substitutability with labour to increase as more and more human tasks become automatable through more advanced implementations of AI models. Moreover, we can expect the downward trend of retail jobs to continue, with wage growth remaining strong and productivity estimated to continue its growth trajectory as hours worked trends downward and retail output maintains historical average growth rates. Retail businesses will closely monitor the most significant proportion of their cost base: workforce pay and benefits. This will drive up efficiency, give consumers the best value, and help keep businesses viable.