Key findings from the latest Local Data Company report, and what they mean for rebuilding the retail sector post-pandemic.

We began 2021 in our third national lockdown, after a turbulent Christmas period which saw varied tier restrictions across the country. As the vaccine rollout gathered pace and restrictions eased, we emerged into a retail market reeling from the effects of a pandemic. Much has been made of ‘recovery’ for the retail sector: what recovery could look like; when we can expect to see it; who will recover, and how; and where we should invest our time and resources to bring recovery about. Our latest report, comprising our research and analysis for the first half of 2021, has already shed light on the cumulative impact of the pandemic on retail, and what we can expect to see in future.

Record growth for independents

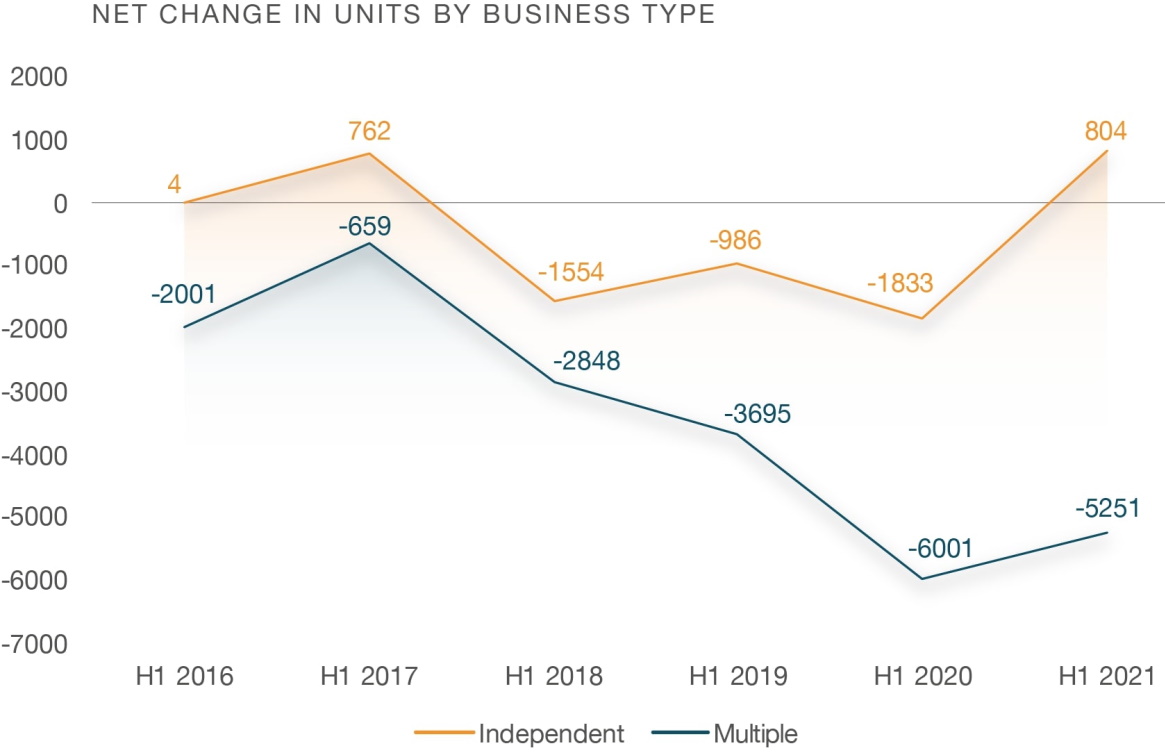

For the past few years, independent retailers have been more resilient than bigger brands. In the first half of this year, independents grew by 804 units, the first increase tracked since H1 2017. This growth was mostly seen in the convenience and leisure sectors; the number of independent grocers, butchers, bakers, cafes and fast food outlets grew. Government support, business rates relief and the commercial rent moratorium helped some businesses remain operational, and a large supply of vacant units allowed independent business owners to negotiate better rent terms. Moreover, local businesses were boosted by customers, not only because they were working from home, but also because of growing consumer trends towards sustainability and supporting small business.

Shopping centres were hardest hit

The effects of high-profile administrations, particularly those of Debenhams and the Arcadia group, are continuing to be felt most acutely by shopping centres. Since H1 2020, the vacancy rate for shopping centres has risen by 3.8%. The loss of major anchor stores caused strain on surrounding retailers, and locations such as retail parks and high streets offered a safer, socially-distanced shopping experience. Not all shopping centres were alike, though: it was the larger retail destinations with a greater exposure to at-risk categories like fashion that suffered most. Smaller community shopping centres, more often anchored by a supermarket and hosting a higher proportion of ‘essential’ retailers, were better placed to cater to local populations in terms of both retail mix and location during periods of restriction.

Fast food takeaway thrives

H1 2021 saw the emergence of a new fastest-growing category: fast food takeaways gained a net 333 units in this period. With restrictions on indoor dining only having been lifted in May this year, we still relied on takeaways as we did in 2020. Fast food brands, which often have established delivery platforms, grew their success by expanding their estates strategically to capture greater residential catchments, with many opening ‘dark kitchens’ to support fast delivery fulfilment.

The full Local Data Company report on H1 2021 is available to download free of charge at www.localdatacompany.com/download-report-h1-2021.

Online shopping is here to stay

It is, perhaps, a sign of the times that we cannot talk about physical retail without talking about the migration of spend to online channels. ONS data revealed that, across retail, online sales made up 28.1% of all spend at the end of H1 2020, an increase of 7.8% in just a year. The pandemic only accelerated this trend, but we seem to have missed the experience of shopping in person: following the reopening of ‘non-essential’ retail, demand for offline shopping did increase. At the end of H1 2021, the proportion of all retail sales made online decreased to 26.7%. However, this is still 7.8% higher than the pre-pandemic figure, indicating that online shopping is here to stay.

Early last year, experts had already posited that physical stores were set to change in terms of purpose and that is indeed happening. Many retailers have shrunk their physical store portfolio, with the remaining locations often acting as showrooms and click-and-collect hubs to support online channels. Some are creating ‘experiences’ at physical stores to excite customers and act as a catalyst for a buyer journey that may end online.

The impact of home working

Major GB cities like London were hit hard by the pandemic in the absence of tourists and commuters. The lifting of restrictions did not see a widespread return to the office and, even with recent reports of greater worker footfall on public transport and in cities, ‘hybrid’ working models may continue to be the norm. As a result, local communities have fared markedly better than commuter cities.

In the near future, we expect more retailers to rationalise their store estates, reducing their physical presence to focus on online channels. Some may follow in the footsteps of GAP and close physical stores completely. The worst of pandemic-related closures should be over by the end of 2021, when most restructuring should be complete. Across categories, retailers will bank on the trends they expect to continue; fast food takeaways may expand beyond a saturated London to open in other regions, for example.

We have all seen how profoundly the retail sector has changed in such a short space of time. As we see the return of colder weather, changes in COVID infection rates may affect restrictions on domestic and international travel, trade and government support for retailers in the last quarter of 2021. Embracing and adapting to emerging consumer trends, such as the growth of delivery apps and increased demand for offline socialising and experiential retail, will give retailers a better chance of thriving amid uncertainty.

To find out more about Local Data Company and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.