Limited access to cash and digital payments is a dangerous combination for elderly customers.

COVID-19 reached the UK last year and struck one of Europe’s most vulnerable nations. The pandemic’s impact has been exacerbated by the U.K.’s own epidemic in financial resilience, with low levels of savings, insurance, affordable credit and financial capability.

For many younger tech-savvy consumers, the transition to a digital world has been almost seamless. But for the near 12 million elderly consumers in the U.K., those most at risk during the pandemic, accessing money continues to be a daily struggle. They are penalised by poverty and loyalty premiums. A recent report suggests as many as 1.9 million U.K. pensioners live in poverty*, largely driven by a lack of access to digital payments and systems that are needed to claim benefits, pensions and reduced rates for tax and utilities.

Consequently, generational inequalities have emerged and there is a real possibility of societal damage lingering into 2021 and the post-pandemic era. If we already knew that elderly consumers struggled to access digital and financial services, why was Covid19 allowed to exacerbate these issues; and, looking ahead, what can the ‘fintech industry do to help solve this problem?

The Emerging Payment Association’s latest report ‘All aboard. The role of the Fintech industry in solving the problems of financial exclusion’ (Download a copy here: https://bit.ly/2XNE6Eo), provides new insights on financial exclusion within niche, typically overlooked, customer demographics such as the young and the elderly.

It contains insight from interviews with a range of stakeholders including banks and payments organisations, consulting organisations, fintechs, independent industry bodies, social interest organisations and consumers. The interviews explored a multitude of factors that contribute to financial exclusion amongst the elderly, deep diving into:

- Lack of digital skills

- Dependence on cash

- Privacy and security concerns

- Physical restrictions

- Lack of customer-centric products

The Findings

There is a huge lack of trust and/or awareness amongst elderly age groups in the U.K when it comes to digital financial products and services.

A lower awareness of these products and services amongst elderly consumers often arises due to low digital literacy and poor internet connectivity. Most elderly consumers do not use the internet daily or even have a mobile phone. Unsurprisingly, a recent ONS survey reported that only 7% of over 70s are likely to have the capability to shop and manage their money online.**

Older people have always been excluded from essential financial services as a result of poor product and service design and direct age discrimination.

Interestingly, their lack of trust is not so much a distrust of the banking companies and their products, but rather, elderly people do not trust their own abilities to spot a scam. Cognitive decline makes elderly consumers increasingly vulnerable to scams. Telephone, online, door-to-door and card scams have proliferated during the pandemic, with 18% of coronavirus fraud victims being in their sixties, though they make up just 11.5% of the population***. As a result, elderly people overwhelmingly prefer heading to their high-street bank branches, speaking to people directly, and handling physical cash.

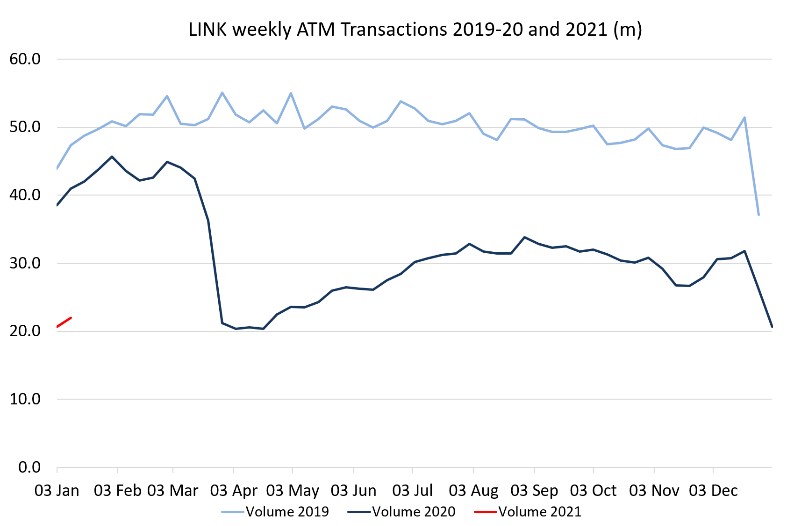

However, in addition to this lack of trust and understanding of digital products, elderly consumers have also been hit hardest by the decreasing availability of cash. Over 2 million people, disproportionately elderly and vulnerable, are entirely reliant on cash day-to-day. Whilst the decrease in cash has been an ongoing trend, it has been extremely exacerbated by the COVID-19 pandemic. During COVID-19, cash usage has reduced by 50%, with 17.1 million Brits avoiding paying with cash due to health and safety fears**** and ATM withdrawals fell by 46% for similar reasons too.*****

Is the FinTech industry responding?

Yet, it is important to note that because of this accelerated financial exclusion, the fintech industry did react quickly and provide solutions for excluded consumers like the elderly.

LINK maintained access to free cash withdrawals and ensured the availability of cash through ATMs and other channels such as the Post Office, PayPoint in retailers and other schemes. At a crucial time, LINK and PayPoint also trialled the ‘Community Access to Cash Pilots’ where retailers are remunerated for providing cash to a consumer without a purchase.

In addition, the exclusion of the elderly has created new avenues for new fintechs to explore. One upcoming market entrant, Flex Money, uses inclusive and hyper-personalised communication to assist those who struggle with the use of digital mobile technologies. For example, larger in-app fonts and buttons are available to help those with conditions like arthritis or who struggle to see.

Building products and services that are simple and transparent, providing easy access to them and building trust will go a long way to address exclusion.

Now that the U.K. can see the light at the end of the ‘COVID tunnel’, it is more important than ever that fintechs, networks and other industry bodies, learn from the disproportionate exclusion experienced by the elderly in the U.K. during COVID-19, and continue to work with retailers to put customers at the heart of everything they do.

This will be an overarching theme for discussion at the Emerging Payment Association’s annual PAY360 conference (16th – 19th March 2021). Sessions include: “Is COVID-19 the end of Cash? Where are the opportunities and what are the implications?” and “The merchants’ payments of tomorrow – challenges and trends in 2021”. Andrew Cregan will be sharing the perspective of our BRC members.

Attendance is free, so register now to discover what new technologie-s are services are on the horizon: https://bit.ly/3bJ2Shl

Data from LINK shows ATM transaction volumes dropped by more than 40% in January 21’ compared to January 20.

https://www.link.co.uk/about/statistics-and-trends/

Flex customers are given a community voice, enabling collective bargaining with retailers to secure discounts or cashback rewards.

References:

*https://bit.ly/35QNg7P

**https://bit.ly/3oNAu1d

***https://bit.ly/3qihjge

****https://bit.ly/3ikpeai

*****https://bit.ly/3oOsT2s

To find out more about Emerging Payments and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.