Key learnings from our 2021 analysis and what they mean for the future of British retail and leisure.

Spring 2021 saw us emerge from a third national lockdown into a changed Britain, bearing the effects of a year of COVID-19. After a four-week delay, ‘Freedom Day’ arrived in July and consumers enjoyed a summer of sport and socialising, although the challenges were far from over. New virus variants (and the threat of them), coupled with travel restrictions and home working, loomed over physical retail, but 2020 seems to have provided an opportunity for retailers to adapt to this wave of change. Looking at the key findings from our 2021 analysis reveals green shoots of recovery amid a continuing state of flux.

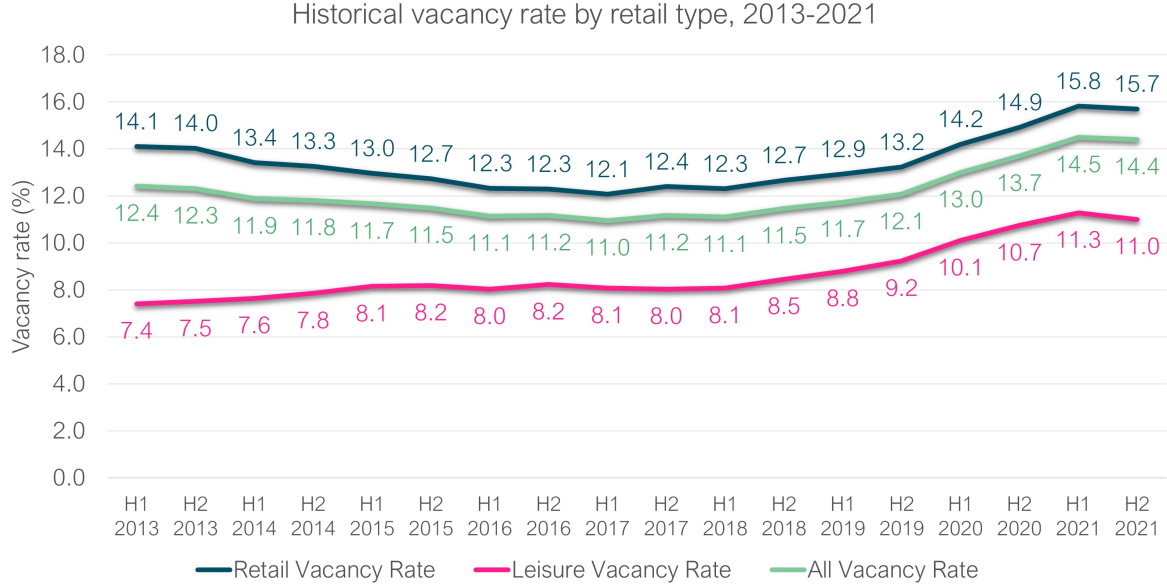

Vacancy rates decline for the first time in three years

The second half of 2021 saw the first decline in GB vacancy rate since H1 2018. This is the clearest sign yet that the market is beginning to stabilise. A decline in vacancy rate was seen across all location types: even shopping centres, recently beset by a host of challenges, led the way with a 0.3% decrease in empty units. Recovery for high streets was more muted, with a 0.1% decline in vacancy seen in the second half of the year. However, high streets have proven resilient compared to pre-pandemic figures, and were not as heavily impacted as other location types to begin with; they have less vacant stock to shed in order to recover. We forecast further reductions to vacancy rates across all location types this year, supported by the ongoing repurposing and redevelopment of retail space.

The gap widens between multiples and independents

The year proved especially challenging for chain retail and leisure brands, compounded by the end of the furlough scheme and the £2million cap on business rates relief which excluded many larger operators. Multiples (defined by LDC as any business with 5 or more units) across the GB market experienced their largest net decline in units on record, -10,059. Larger brands continued to reduce the size of their physical store estates or close shops altogether, investing instead in online channels which now account for a large share of sales.

By contrast, independents continued to thrive; the independent retail and leisure sector saw a net increase of 2,157 units over 2021. This marks the first time that more independents have opened than closed in Great Britain since 2016. Home working has contributed to increased sales for local businesses, with more of the population staying— and spending— closer to home.

The full FY 2021 report is available free of charge at https://www.localdatacompany.com/retail-and-leisure-analysis-fy-2021.

Redevelopment activity reaches a record high

Redevelopment activity within the commercial property space saw a record increase of 49% in 2021. Considering that the first three months of the year were spent in lockdown, this increase reflects the scale and significance of this activity. Relaxed property laws allowed for greater flexibility for investors and planning authorities. The majority of redevelopment was seen in Greater London (26%) and the South East (14%), although there was a considerable increase in activity in major Northern cities, and the government’s Levelling Up scheme is set to provide further support as a backlog of planning approvals continues to come through and larger projects resume.

Recovery in the leisure sector

The leisure sector was particularly impacted by the pandemic; restrictions on table sizes, social distancing measures, cancelled events and reduced international tourism further increased the pressure. However, the sector rebounded strongly in 2021. Leisure in GB saw a net loss of only 52 units, the best this figure has been since 2016. The change was led by growth in the fast food takeaway, independent café and restaurants & bar categories. Independent cafés in particular benefited from the closures of national chain coffee shop sites in prime locations, reducing local market saturation and creating openings for new businesses. Hospitality businesses were able to trade during the lockdown in 2021 and many had already invested in their takeaway and delivery offer to strengthen sales and help them weather the effects of the pandemic.

The impact of home working

Although many workers returned to the office after over a year of working from home, many others did not, and hybrid working patterns have proven popular at some companies. This significantly impacted city centres— vacancy rates for these locations ended up at 17.1%, an increase of 3.5% on 2019 levels. Vacancy rates across Britain’s biggest working districts increased by 4.6% from March 2020. As home working continues, so will reduced levels of footfall across these spaces. Many takeaway food shops, banks and coffee shops have already moved away from these areas, although this presents opportunities for brands that currently have limited exposure in this market, with an influx of prime vacant space available for those able to capture the remaining crowd.

We don’t expect a full return to pre-pandemic levels of performance yet, but we forecast a continued decline in vacancy rate supported by continuing redevelopment and repurposing activity. Recent pressures caused by the Omicron variant and changes to government support packages for the sector may not have as profound an effect as one might think: two years of living with COVID-19 has allowed retailers time to negotiate, restructure and adapt. The 2021 data strongly suggests that, although we are not truly ‘post-pandemic’ yet, the worst effects of the pandemic are over for the retail market at large.

To find out more about Local Data Company and the services they provide to the retail industry, click here.

This article was also published in The Retailer, our quarterly online magazine providing thought-leading insights from BRC experts and Associate Members.